Key takeaways:

If your dream is to own your home, but you need some extra help saving for a down payment, there's good news: first-time homebuyers can use both the First Home Savings Account (FHSA) and Home Buyers' Plan (HBP) to buy a home.

Read on to learn more about how you could leverage both a FHSA and an HBP to become a homeowner.

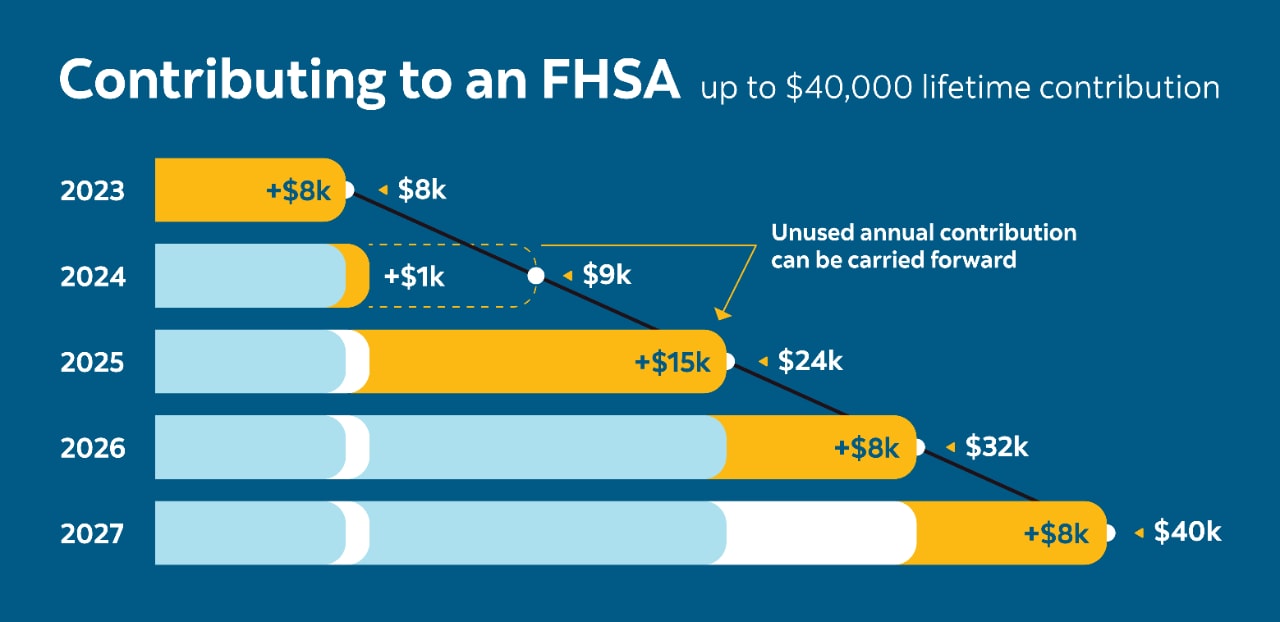

The government launched the First Home Savings Accounts (FHSA) in 2023. This program is designed to help Canadians looking to save towards their first home. As a tax-free savings account, it allows contributions up to $8,000 per year, for a lifetime contribution total up to $40,000, towards a qualifying home purchase.

If you fall short in contributions one year, you won't miss out. Any unused annual contribution amount can be carried forward to the next year up to $8,000.1 (But if you over-contribute, you'll be subject to a 1% tax per month on the excess funds.)

There are valuable tax benefits, too. Not only does the money you invest grow tax-free (similar to the TFSA), the contributions you make are tax- deductible (like the RRSP).

You can make either a single withdrawal from your FHSA or multiple withdrawals. But to start making withdrawals, you'll need to fill out the form “RC725 Request to Make a Qualifying Withdrawal from your FHSA" for each account you own.2

Keep in mind that if you end up using the funds you withdraw to buy something other than a home, those funds will become taxable.

To qualify for an FHSA, you must be:

- A Canadian resident

- 18 years of age or older (but not turning 71 or older within the calendar year)

In addition, you or your spouse cannot have owned a home where you lived at any time in the year the account is opened or during the previous four calendar years.

There are a few other rules you need to follow:

- The property must be in Canada.

- The house must be built or bought by October 1 of the year following your withdrawal.

- You'll need to close your account after 15 years or when you turn 71.

The Home Buyers' Program (HBP) is a program that allows first-time homebuyers to withdraw money from a Registered Retirement Savings Plan (RRSP) to buy or build a home for themselves or for a person they're related to who has a disability.3

How this popular program works is that individuals can withdraw a maximum of $60,000 from an RRSP within a tax year. If both people in a couple are eligible, they could combine their withdrawals up to $120,000. The amount withdrawn is tax-free for the first-time home purchase, so long as you follow the repayment schedule and have the money back in your RRSP within 15 years.

To start making withdrawals, you'll need to fill out the form “T1036 Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP" for each account you own.4

You may be wondering, "Am I eligible for a HBP?" To qualify for the Home Buyers' Plan, you must be:

- A Canadian resident

- A first-time homebuyer

- Buying or a building a home that will be your principal place of residence, or the person with the disability must live in the home within the first year

There are also certain rules you need to follow:

- The property must be in Canada.

- The house must be built or bought by October 1 of the year following withdrawals.

- You'll need to begin repaying the funds to your RRSP in the fifth year and make the minimum annual repayment. If you don't meet this amount, the difference will be considered as RRSP income.

- You'll need to repay your RRSP within 15 years.

While both the FHSA and HBP can help first-timer homebuyers achieve homeownership, there are a few key differences.

One of the biggest differences is that you'll have to pay back the money you withdraw from your RRSP for the HBP. When you think about it, you're essentially borrowing money from your RRSP (which typically is reserved for your retirement), so you're required to make repayments. But you will have time to do this gradually. You have up to 15 years to top up your account.

On the other hand, with the FHSA, the money you contribute is tax- deductible and the withdrawals are tax-free when you use it towards your qualifying home. Basically, you're not borrowing money so there's nothing you have to pay back.

Combining the FHSA and HBP to buy a home

So now, you may be thinking to yourself, "Should I choose the FHSA or the HBP to save for my home purchase?" There's no reason to choose because you can have the best of both worlds.

You're able to (if eligible) combine funds from the FHSA and HBP for the same qualifying home purchase. Taking advantage of both can help you save for a down payment.

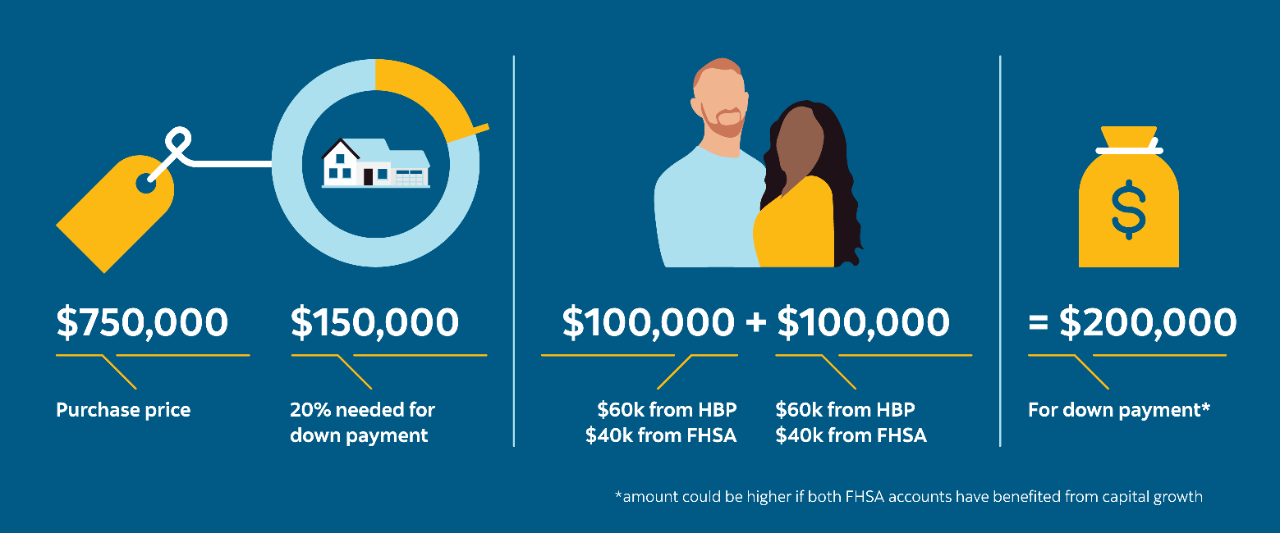

Let's say, a couple (who never owned a home before) is looking to buy a house worth $750,000.

For a 20% down payment, they would need to save $150,000 (20% of $750,000). Both individuals have their own FHSA and HBP.

By taking $60,000 from the HBP and $40,000 from the FHSA (or potentially more as this investment grows), each person will be able to contribute $100,000.

This gives them a combined total of $200,000 ($100,000 x 2) — but the amount could be higher if both FHSA accounts have benefited from capital growth.

By making regular contributions to their FHSA and RRSP, this couple will optimize saving for a down payment.

Ultimately, as long as you follow all the rules and repayment requirements, you'll be able to use the benefits of these accounts towards your goal of buying a home.

Homeownership may seem out of reach for many as home prices and inflation are making it challenging to buy a home. But by leveraging both the FHSA and the HBP, you're one step closer to buying your very first home. You can work with a Scotia Advisor to come up with a financial plan to make this dream a reality.

This article is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and The Bank of Nova Scotia is not responsible to update this information. References to any third party product or service, opinion or statement, or the use of any trade, firm or corporation name does not constitute endorsement, recommendation, or approval by The Bank of Nova Scotia of any of the products, services or opinions of the third party. All third party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

2 https://www.canada.ca/en/revenue-agency/services/forms- publications/forms/rc725.html

4 https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t1036.html