Are you in your final year of high school? If so, you're probably getting excited about your next step. If post-secondary is part of your future plans, you might be researching tuition and what financial support is available to students in Canada. This guide to student financing is put together to help you in that process.

Key takeaways:

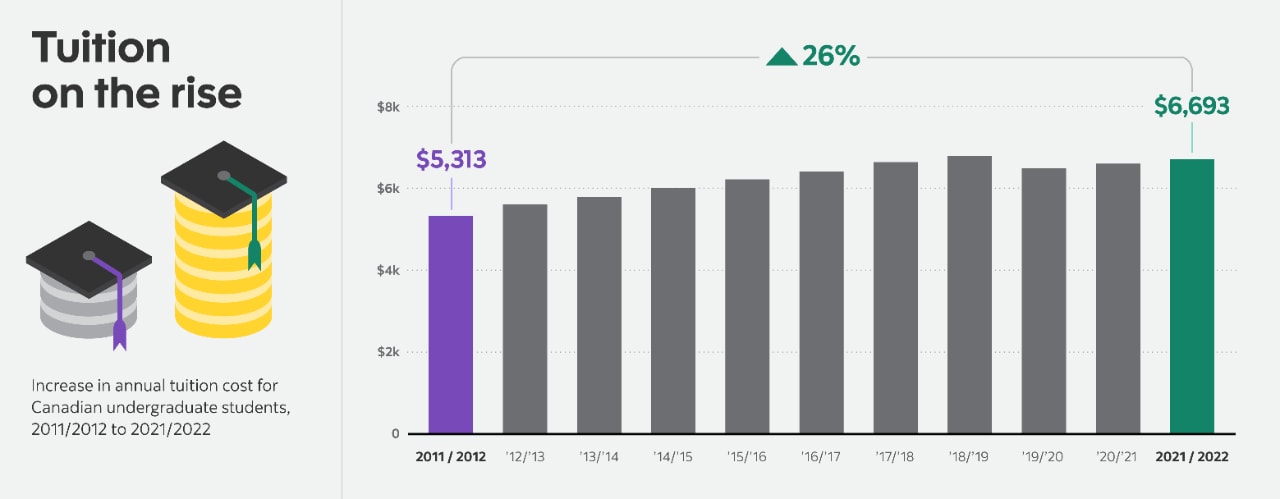

With the average cost of full-time tuition sitting at $6,834 annually1, student loans are a popular choice for many students. If you have an RESP, you need to figure out how much of your education it will cover and if you'll need to fund any of it on your own.

Another option that many Canadian students turn to is funding their higher ed through government and private student loans. According to the Canadian University Survey Consortium (CUSC)2, 46% of graduating students report having debt, with government student loans being the most common source. Read on to learn more on how student loans work in Canada.

Below we break down some of the ways you could pay for your education.

Student loans

First off, what is a student loan? A student loan is money you borrow from a lender (like the government or a bank) to fund your education. A student loan is a very popular way for Canadian students to fund their higher education.

Private student loans often come with a higher borrowing limit than government student loans, which can help you to cover any gaps in funding. Private student loans typically have a higher interest rate than government loans, but there are exceptions. Many private lenders also require you to have a credit history, which isn't necessary for a government student loan.

Before you take on a loan, make sure you understand exactly what it means to take on debt. You also want to have a plan in place to pay the money back when you finish your studies.

Student line of credit

A student line of credit is the most popular type of private student loan funding. A line of credit allows you to borrow money and only use what you need. If you don't use the money, you aren't charged any interest. This can be a good option for students who think they might need financial support but don't know exactly how much.

Student grants and scholarships

A grant is another form of financial aid that's offered based on financial needs. The difference between a student loan and a student grant is that you don't have to repay a student grant. It's basically free money. The same goes for a scholarship. It takes work to apply for a scholarship but, if you receive one, the money is yours to keep. On the other hand, student loans must be paid back, with interest.

In 2022, four in 10 students were employed during their first year, working approximately 17 hours each week.2

Work while you study

One way to offset some of the costs associated with being a student, whether it be to pay off your loan or cover your student living costs, is to have a part-time gig while you study or to pursue an internship. Survey results from the Canadian University Survey Consortium (CUSC) revealed in 2022, four in 10 students were employed during their first year, working approximately 17 hours each week.2 While this may seem like a lot to take on while you're studying, having a side hustle could help you to land a job after you graduate while also putting more money in your bank account.

There are two main sources of student funding in Canada: government funding and private funding. These can be further broken down into the following three sections:

- Federal government student loans and grants

- Provincial and territorial student funding

- Private funding which includes student loans and student lines of credit

1. Federal government student loans and grants

The Government of Canada offers loans to eligible part-time and full-time students through the National Student Loans Service Centre (NSLSC)opens in a new tab. When you apply for a federal student loan, you'll automatically be assessed for Canada Student Grants and Loans. The total loan amount you may receive depends on several factors, including:

- Tuition fees and education costs

- Your savings/financial contributions

- Your living situation

- Your annual income

- Financial assets and investments (for full-time students only)

You can use the Government's Student Financial Assistance Estimatoropens in a new tab to get an idea of how much you might be eligible for in grants and loan.

2. Provincial and territorial student funding

If you don't qualify for federal funding, you could try to get financial aid from your province or territory. Here's a list of provincial and territorial student loan aid resources you can check out for more information on eligibility and the application submission process.

Provincial and territorial student aid offices

- Alberta Student Aidopens in a new tab

- British Columbia Student Aidopens in a new tab

- Manitoba Student Aidopens in a new tab

- New Brunswick Student Financial Servicesopens in a new tab

- Newfoundland and Labrador Student Aidopens in a new tab

- Northwest Territories Student Financial Assistanceopens in a new tab

- Nova Scotia Student Assistanceopens in a new tab

- Nunavut Student Fundingopens in a new tab

- Ontario Student Assistance Program (OSAP)opens in a new tab

- Prince Edward Island Student Financial Servicesopens in a new tab

- Quebec Student Financial Aidopens in a new tab

- Saskatchewan Student Loansopens in a new tab

- Yukon Student Financial Assistanceopens in a new tab

Note that you don't have to apply separately for federal student aid and provincial or territorial student loans. When you fill out an application, it covers both federal and provincial or territorial funding. If you receive a government grant, you don't need to repay it. However, you need to pay back your student loans with interest six months after you've completed your schooling. The government provides a six-month non-repayment period where no interest will be added onto your loan, but once it's up, you'll need to make payments.

3. Private student loans and lines of credit

If you don't receive enough government funding to cover the cost of your education, you can also look into private student loans and lines of credit offered by banks and alternate lenders.

Federal student loans vs. private student line of credit

There are a few differences between a government and private student loan:

Government student loan |

Private student line of credit | |

Amount you have to pay back |

You're given a lump sum amount of money and, you're responsible for repaying the entire amount, plus interest |

You're only responsible for repaying the amount you use, plus interest |

| When you start paying interest | You don't start paying interest until you finish your program or leave school | You start paying interest as soon as you borrow the money |

| Amount you can borrow | There are loan limits on the maximum amount of combined federal and provincial student loans that can be received | You can often borrow more money than you can get with a government student loanl |

Access to repayment assistance program (RAP) |

Eligible for Repayment Assistance Plan (RAP) |

Not eligible for RAP |

Now that you know what student financial options are available to you, below are some answers to the most common questions, students like yourself are asking.

How to apply for government student loans and grants?

To apply for student assistance, you'll need to:

- Meet eligibility requirements. Eligibility is based on criteria including citizenship status, financial need, course load and more.

- Fill out an application. Your application can be completed online through the student financial assistance site for your specific province or territory.

- Wait for Notice of Assessment. You'll receive a Notice of Assessment through the mail, online, or by email indicating if you qualify for grants and loans.

- Review and accept terms and conditions. You're required to review your Master Student Financial Assistance Agreement (MSFAA) to ensure all of your personal information is correct and you understand the terms of the agreement.

- Submit loan documents. You'll log in to your NSLSC account to complete and sign your MSFAA online.

- Loan disbursement. Your loan or grant will be deposited into your bank account or forwarded to your school to pay for your fees.

You can visit the NSLSC websiteopens in a new tab for additional details on how to apply.

Who is eligible for student loans and grants in Canada?

To qualify for a Canada Student Grant or Loan, the government outlines specific eligibility criteria that you must meet, including:

- Must be a Canadian citizen, permanent resident of Canada or designated as a protected person

- Must be a permanent resident of a province or territory that offers Canada Student Grants or Loans

- Must demonstrate financial need

- Full-time students must be enrolled in at least 60% of a full course load.

- Students with a permanent, persistent or prolonged disability must be enrolled in at least 40% of a full course load.

- Part-time students must be enrolled in 20 to 59% of a full course load.

- Students must be enrolled in a degree, diploma or certificate program offered by a post-secondary school that runs for a minimum of 12 weeks within 15 consecutive weeks.

What is the maximum amount of student loans I can get in Canada?

The maximum amount of money you can receive through provincial or territorial loans will depend on several factors, such as:

- Province or territory of residence

- Family income

- If you have dependents

- Tuition fees and living expenses

- If you have a disability

Do I have to apply for a government student loan each semester?

To receive funding, it's important to remember to reapply for your student loan every school year. Since it's possible for your financial situation to change each year, you have to submit a new application once a year.

When do I have to repay my government student loans?

Once you've reached your maximum amount, you have six months after you graduate to start repaying your loans. The purpose of the six-month grace period is to give you time to search for a job and transition from student life to "grown-up" life. If you're able, you can start repaying your loans before the six-month period and you won't be charged interest during that time.

The government offers a Repayment Assistance Plan (RAP)opens in a new tab and the Repayment Assistance Plan for Borrowers with a Permanent Disability (RP-PD) for students struggling to make their monthly payments. You can apply for the plan at any time during the repayment period and if you're approved for RAP, your payment will never exceed 20% of your gross income. In some cases, your payment might be reduced to zero.

Do student loans expire after 10 years in Canada?

Not all Canada student loans expire after 10 years. If you're approved for RAP, the maximum amount of time that you can be in repayment once you leave school in most cases is 15 years, or 10 years if you have a disability.

Does Canada have student loan forgiveness?

Loan forgiveness programs are available to Canadian students. For instance, family doctors and nurses opens in a new tabin family medicine can apply for the Canada Student Loan forgiveness program. Family doctors or residents in family medicine may be eligible to $40,000 in Canada student loan forgiveness over a maximum of five years ($8,000/year). Nurses and nurse practitioners who qualify can receive up to $20,000 in loan forgiveness over a maximum five-year period ($4,000/year).

Some provinces also offer student loan forgiveness programs, including:

- B.C. loan forgiveness program.opens in a new tab Those who are eligible can have up to a maximum of 20% of their loan forgiven per year for up to five years.

- Nova Scotia student loan forgiveness program.opens in a new tab Students graduating from Nova Scotia in a non-professional undergraduate program may be eligible to receive five-year loan forgiveness to a maximum of $20,400.

- P.E.I. debt reduction programopens in a new tab. Students graduating from post-secondary with more than $6,000 in federal and provincial student loans borrowed per year might be eligible for the P.E.I. debt reduction grant.

What are the new rules for student loans in Canada?

In the 2022 budget, the Government of Canada proposed several new supports to help students pursue post-secondary education. These changes include:

- Increasing loan forgiveness for doctors and nurses. The government is increasing loan forgiveness for doctors and nurses working in rural communities. As of 2023, nurses can qualify for up to $30,000 in loan forgiveness, and doctors up to $60,000. The government is also expanding the list of eligible professionals that can participate in this program.

- Elimination of loan interest. As of April 1, 2023, Canada student loans are interest-free. The government has permanently eliminated the accumulation of interest on all Canada Student Loans, including loans currently being repaid.

- Student grant supports. The government has extended doubling the maximum amount of Canada Student Grants until the end of July 2023. Students can also use their current year's income to determine their eligibility for student grants instead of their previous year's income.

- Improvement to RAP. As of November 1, 2022, anyone who lives alone and is approved for the repayment assistance program does not have to pay their student loans if they earn less than $40,000 per year. This amount increases based on family size. The government also lowered maximum payments from 20% to 10% of household income.

- Greater support for borrowers with disabilities. Effective August 1, 2022, the government has extended disability supports to students with persistent or prolonged disabilities.

- Extension of Skills Boost Program. The Skills Boost Program helps working adults offset the cost of returning to full-time school to upgrade their skills. This was originally a three-year pilot program that ended in 2021. The government has extended it for an additional two years, ending in July 2023.

When do I have to pay back my private student loan?

Certain banks provide students with more time to repay their loans than with government funding. For instance, Scotiabank offers students the ScotiaLine® Personal Line of Credit. After graduating, you have a 12-month grace period to begin repaying the principal amount borrowed. You'll have to start paying minimum interest payments as soon as you borrow the money. If you plan to use a private lender to fund your education, make sure that you understand your repayment terms before accepting a student line of credit.

What happens if I don't pay my student loans?

If you miss nine months of student loan payments, the federal portion of your loan is sent to the Canada Revenue Agency (CRA) for collection. Once your loan is in collection, you can no longer access student aid. If you want to get student aid in the future, you'll have to pay off your loan debts first. For information on the provincial or territorial portion of your loan, you can contact the specific province or territory.

Late and missed student loan payments can also negatively affect your credit score, making it more difficult for you to borrow money in the future. If you're thinking about filing for bankruptcy because of your student debt, know that your Canada student loans will not be cancelled if it's been less than seven years since you finished your studies. If you file for bankruptcy seven years after you were a part or full-time student, your student loans are eligible for discharge in bankruptcy.

What do I need to know about student financing as an international student?

Canada is a beautiful place to choose for studying with stunning mountains, scenic prairies, world-renowned cities, and prestigious universities. If you're an international student considering studying in Canada, you may have questions about the requirements, preparations, and post-graduation settlement options. Take a look at our student guide for international students, to help you with some research on what to do when you want to study in Canada as an international student.

If you're a high school student entering your final academic year, it's important to start thinking about how you'll fund your post-secondary education as soon as possible. No matter what option you choose having a budget in place, before you enter your post-secondary program will help you stay financially on track and avoid taking on unnecessary debt.

If you’re a Scotia customer, you can use Scotia's mobile app to view your account balances and track your spending to ensure you are building an accurate budget. Then keep revisiting your budget while you're in school so you can make adjustments to your spending to put yourself in a good position for the future. Before taking on any type of loan, make sure that you understand your repayment options and have a plan in place for how you'll repay the money.

You should also consider opening a student bank account prior to applying for funding so any scholarship, grant or loan money has somewhere to go. Scotiabank offers student bank accounts specifically designed for student life.