Key takeaways:

A home is likely one of the biggest purchases you ever make. In Canada, saving for a large down payment can be challenging — especially for your first home. But with the Home Buyers' Plan (HBP), you can leverage your retirement savings to help bring you one step closer to becoming a homeowner.

The Home Buyers' Plan (HBP) is a government program that lets you withdraw money from your registered retirement savings plan (RRSP) to buy a home.1 An important thing to remember though is that you’ll need to repay the amount you've borrowed from your RRSP within 15 years.

You'll also need to meet certain eligibility requirements to qualify for the HBP:

- You must be a first-time homebuyer

- You'll need a written agreement to buy or build an eligible property in Canada for yourself or for a related person with a disability2

- You have to be a Canadian resident

A few other important details:

- The home must be located in Canada, and it must be bought or built by October 1 of the year following the year you withdraw funds. (For example, if you started to withdraw funds on January 1, 2023, then you need to complete the purchase or construction of your home by October 1, 2024.)

- You or the person with the disability must live in this home — ex. it has to be your principal residence — within one year of buying or building it.

There can be different eligibility criteria that applies to you and your spouse or common-law partner. For example, even if you live together, you could still qualify as a first-time homebuyer if your partner is the sole homeowner.

Also, if you and your partner lived apart for at least 90 days for the past four years, you may be eligible to withdraw funds through your HBP.

Even if you're not planning a big move, you may have an unexpected opportunity outside of Canada. If you become a non-resident of Canada either before or after you purchase a home, be sure to follow the specified rules and fill out certain sections when filing your taxes.3

There are several advantages to having an HBP:

- It gives you the ability to have an interest-free loan, as long as you follow the repayment plan.

- You can borrow up to $60,000 to put towards your down payment.

- You can use the HBP in combination with other registered accounts to save towards your home, like the first home savings account (FHSA) and tax-free savings account (TFSA).

For eligible first-time homebuyers, the current maximum withdrawal limit is $60,000 in a single tax year. For a couple, if each individual has their own RRSP and can withdraw $60,000 each, they can withdraw a combined total of up to $120,000.

Please note that effective April 17, 2024, the maximum HBP withdrawal limit was increased from $35,000 to $60,000. If you withdrew the maximum amount of $35,000 from your RRSP under the HBP, prior to April 17, 2024, you can withdraw an additional amount of $25,000 from your RRSP under the HBP before December 31, 2024, provided you meet the HBP withdrawal criteria for each withdrawal.

There's one restriction: you aren't allowed to withdraw from a locked-in RRSP or group RRSP.

To start receiving funds, you'll need to fill out the T1036 Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP form.4 If you have multiple RRSPs, you'll need to submit forms to each financial institution.

It's essential to plan ahead for when you think you'll need to withdraw your money. That's because your contributions need to remain in your RRSP for a minimum of 90 days before you can withdraw them under the HBP. After 90 days, you can start withdrawing money for your down payment.

If you don't follow the HBP 90-day rule, the contributions may not be deductible for any year.

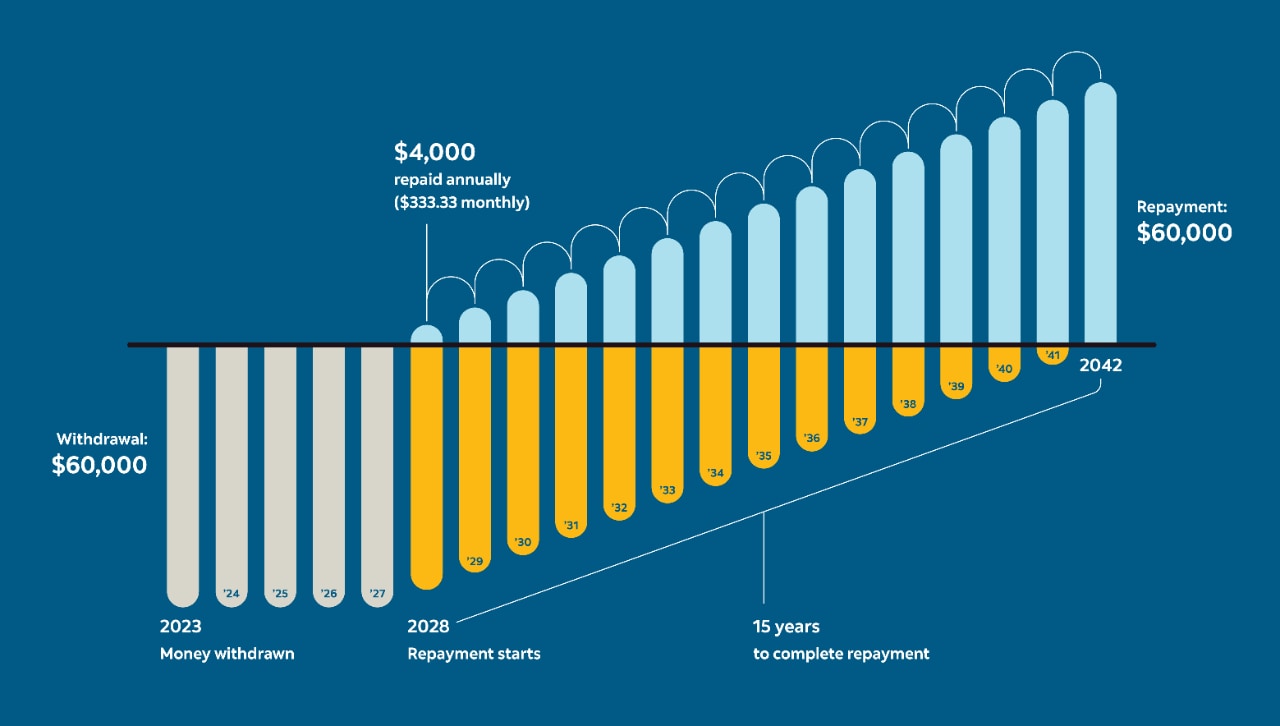

Eventually, you'll have to repay the funds to your RRSP. The repayment period begins two years after you began to withdraw funds. To make repayments, you can make contributions towards your RRSP in the year that it's due or within the first 60 days of the following year. You'll have up to 15 years to pay everything back.

If you make a first withdrawal between January 1, 2022, and December 31, 2025, the start of the 15-year repayment period has been deferred by an additional 3 years (you now have five years to begin repayments, instead of two).

For example, if you start withdrawing money in 2023, you'll need to start repaying the funds in 2028 and will have until 2043 to complete the repayments. Let's say you took out the full $60,000. You'd owe $4,000 annually for 15 years. If you take that amount and divide it by 12, the monthly payment would be $333.33.

You'll receive a statement about your account balance each year. You can also view the balance you owe using the Canada Revenue Agency's My Account or mobile app.

One thing to keep in mind: each year, you'll be required to pay a minimum amount, and there are consequences for missed repayments of your annual amount. If you pay less than the required annual amount or none at all (up to 1/15th of the amount), you'll have to report the difference on line 12900 of your tax return as it will be counted as RRSP income for that year.

On the other hand, if you repay more than the annual amount, the HBP balance for future years will be reduced accordingly. You'll still be required to make repayments for the following years until your balance is zero.

Not all contributions can be designated as repayments. For example, the contributions you make to your common-law partner or spouse's RRSP or specified pension plan (SPP) aren't considered repayments.5 Be sure to review all the rules to find out what are considered to be repayments.6

HBP withdrawals will affect your income tax returns and taxable income. In other words, this means more tax forms.

When you begin making repayments to your RRSP, you'll need to fill out the following form every year you file your taxes until the balance is repaid in full: Schedule 7, RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities.7

Some good news: as a first-time homebuyer, you may also be eligible for additional tax credits:

- First-Time Home Buyers' Tax Credit, which for 2022 provides a tax credit of up to $1,500.8

- GST/HST new housing rebate, which allows eligible homebuyers to recoup a portion of the federal and/or provincial taxes they've paid for a new or renovated home.9

- First-Time Homebuyer Incentive, which gives eligible new homeowners an interest-free loan between 5% to 10% of a home's price to help lower their mortgage payments.10

Sometimes, circumstances change and you might decide to sell your home. If you sell your home while participating in the HBP, you'll still follow the same repayment deadline to pay off your outstanding balance. You could make a lump sum payment to pay it off faster or stick to the original payment schedule.

There's an important consideration about those HPB funds that you shouldn't ignore. The money you withdraw to pay for your new home is money that you're taking out of your retirement savings. Even though you have up to 15 years to repay the money you're redirecting towards a home purchase, it's beneficial to pay it back sooner. Taking longer to make repayments can impact your retirement goals, since those funds are losing out on earning compound interest.

The reality is, many first-time homebuyers need down payment assistance. The newest investment option is the tax-free First Home Savings Account (FHSA), which allows you to contribute up to $8,000 per year, up to a total of $40,000, that can go towards your down payment.

Don't forget the Tax Free Savings Account (TFSA), where you can contribute and let your money grow tax-free. The contribution limit for 2023 is $6,500. Find out your what your lifetime contribution room through your myCRA account. 11

The sooner you begin setting aside money towards your home purchase, the easier and faster it will be to achieve your savings goal. Since you'll most likely need a large down payment to afford a house in Canada, you may consider using a combination of registered accounts, including the FHSA and TFSA. If you’re ready to explore using the HBP, one of our Scotiabank advisors will be here to help you.

This article is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and The Bank of Nova Scotia is not responsible to update this information. References to any third-party product or service, opinion or statement, or the use of any trade, firm or corporation name does not constitute endorsement, recommendation, or approval by The Bank of Nova Scotia of any of the products, services or opinions of the third party. All third-party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Sources:

4https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t1036.html

10https://www.canada.ca/en/financial-consumer-agency/services/mortgages/down-payment.html