Key takeaways:

Have you ever looked at your bank account statement and wondered, “Where’s all my money going?” If you're not tracking your income and expenses, you might find you get to the end of your money before the end of the month. With the uncertainty and fluctuations of today's financial climate, it's essential to take the time to get a clear picture of your finances. To gain a better understanding of what's happening with your money, consider implementing a personal cash flow strategy.

A personal cash flow strategy gives you a clear picture of your financial situation. You can use this information to adjust how you manage your money.

Here's what you need to know about a personal cash flow strategy, how to calculate the money that's coming in and going out, and tips for improving your cash flow to achieve your financial goals.

A personal cash flow strategy involves managing your income and expenses effectively. It includes budgeting, saving, investing and making sure your income covers your essential needs while allowing for short- and long-term goals.

You only need two simple tools: a net worth statement and a cash flow statement.

Your net worth is made up of your current assets (what you own) minus your current liabilities (what you owe). Among other things, your assets include savings, investments and property you own. Your liabilities are outstanding loans, such as a mortgage, car or personal loan, or credit card balances.

To get your net worth, subtract your total liabilities from your total assets. If you owe more than you own, you have a negative net worth. If you own more than owe, you have a positive net worth.

Knowing your net worth is crucial because it gives you a clear picture of your current financial standing and helps you set financial goals.

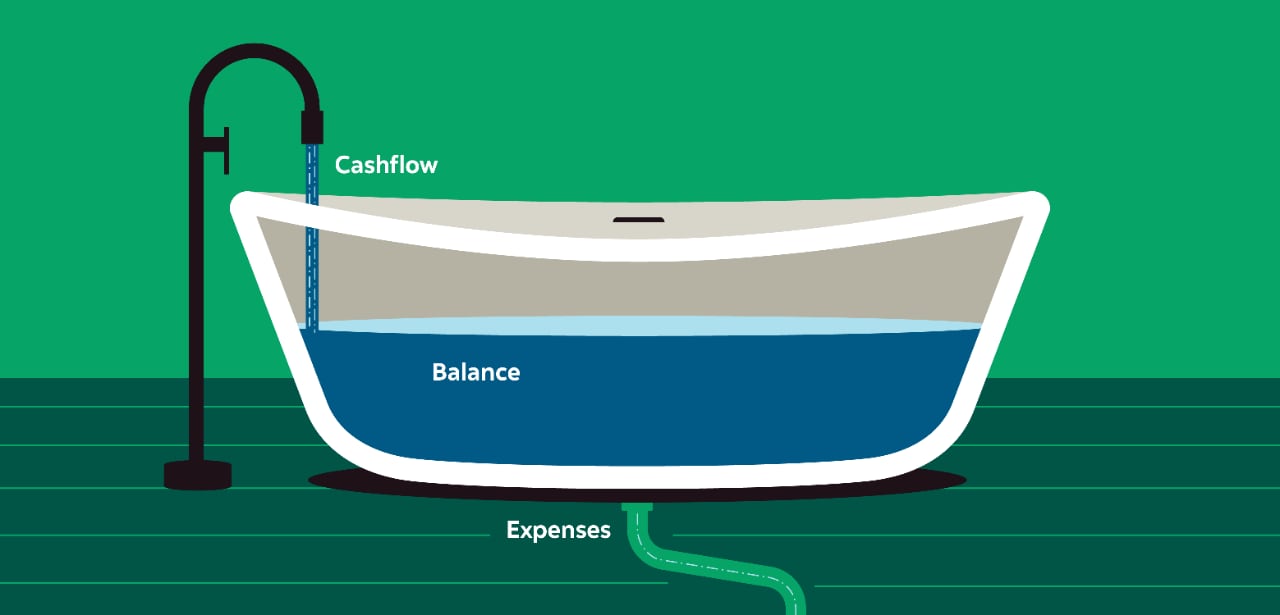

A personal cash flow statement is a detailed record that shows your overall financial health. Managing your cash flow is important because it helps you see if you’re financially stable — and whether you’re on track to meet your financial goals.

The process of creating a personal cash flow statement helps you see why you do — or don’t — have money left at the end of the month. If you’re coming up short, you can start looking for ways to cut costs or boost your income. If you have money left over, you can consider how to invest or save it.

Track your inflows and outflows over three months. This will give you a more accurate picture of where your money is going, and you'll have more information to work with to make a plan, going forward.

Here’s how to get started.

1. Calculate inflows (how much money is coming in)

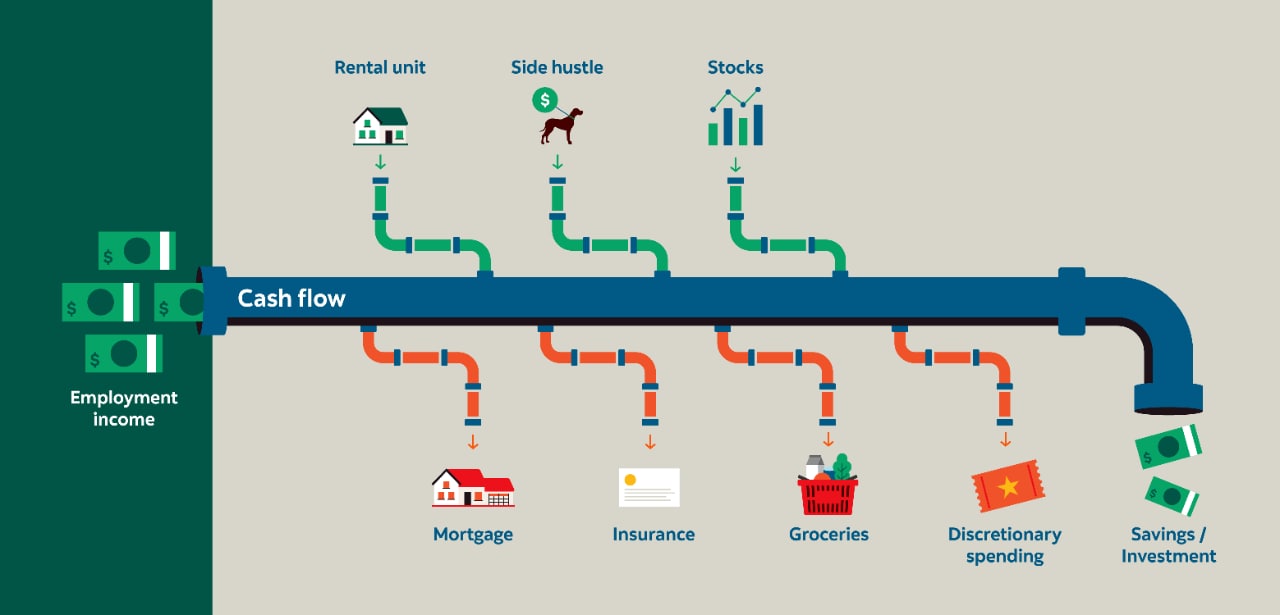

Start by looking at your sources of income. Net income from your primary employment (what you take home after taxes) usually makes up the foundation of your cash flow statement. But you may have other sources of reliable income from things like side businesses, alimony or child support.

Be sure to record other forms of cash in your cash flow statement, such as tax benefits, inheritance or if you get a bonus.

Add together your monthly pay stubs and any other consistent income to calculate your total monthly inflow.

2. Calculate outflows (how much money is going out)

Next, take a look at your outflows – these are your expenses. You’ll subtract these items from your inflow balance.

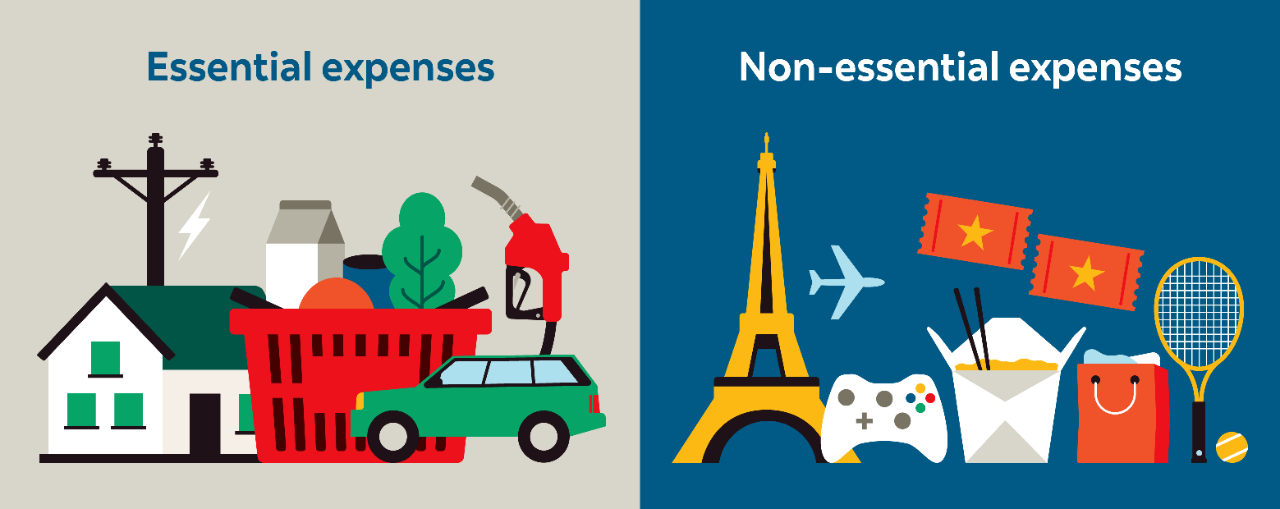

Expenses generally fall into two categories:

- Essential expenses include things like rent or mortgage payments, insurance, utilities, groceries and transportation costs.

- Non-essential expenses include discretionary spending items like gym memberships, gifts, dining out or entertainment, and vacations.

Don't forget to include your current debt and related monthly payments in your overall budget. If you have a credit card balance, track it as an expense and include both charges and payments in your cash flow statement, even if you pay off the full balance monthly. Carrying a balance? Include minimum payments and interest charges.

Also, include any amounts that you’re contributing to savings accounts or an emergency fund. While it’s considered an expense on your cash flow statement, having these financial cushions in place allows you to cover unexpected expenses without piling up debt.

3. Calculate your net cash flow

Use this simple formula to figure out your net cash flow:

Net cash flow = Total cash inflows – Total cash outflows

In other words, subtract your expenses from your income to arrive at your net cash flow.

4. Analyze your cash flow statement

A positive cash flow means that you have more cash coming in than going out — that’s generally a good thing. Once your expenses are covered, you can use the excess to invest or save. You’ll also want to be cash flow positive if you’re looking to buy a house or want to fund your retirement.

Negative cash flow means you’re spending more than you’re earning. You may need to make some changes in how you manage your money, so you don’t fall deeper into debt.

The higher your cash flow, the more flexibility you’ll have to meet your financial goals. Here are a few ways to help you do that.

1. Cut your expenses

Extra expenses can add up quickly, and sometimes we don’t even notice them. Like the streaming services you’re not watching, or that gym membership you totally forgot you were paying for. Review your discretionary expenses and look for things you can cut back on, or even get rid of.

2. Start saving automatically

Scotia offers two smart saving tools that can help you save automatically — Pay Yourself First and Savings Finder.

- Pay Yourself First is a tool that helps you set up automatic transfers from your recurring deposits, like payroll, right into your Money Master Savings Account. You set the amount or percentage, and this tool monitors your spending patterns, expenses and incoming funds and then moves money when it appears you can afford it.2

- Savings Finder is a tool that looks at your source of income and cash flow to find ways to save small amounts here and there from your chequing account into your Money Master Savings Account when it appears that you can afford it.3 You set the monthly savings target, and Savings Finder will do the rest.

Both tools allow you to set savings goals and help you keep track of money movement with notifications. Plus you’ll get an ongoing interest rate boost on your Money Master Savings account while you’re enrolled in the tool.4 Learn more about the tools here.

3. Use credit card rewards if you can

Extra expenses can add up quickly, and sometimes we don’t even notice them. Like the streaming services you’re not watching, or that gym membership you totally forgot you were paying for. Review your discretionary expenses and look for things you can cut back on, or even get rid of. Some credit cards may allow you to earn rewards, like points, or cash back on certain purchases.

Each credit card works differently — some offer points when you spend on certain categories such as groceries or gas.

Others, like the Scotia Momentum® Visa* Card, earn cash back rewards, meaning your cash back builds up each month as you spend, and you get a payout once a year. At the end of 12 months, whatever cash back you’ve earned appears as a credit on your November statement, or you could choose to deposit it to your chequing or savings account.

Points cards, like Scotiabank's credit cards that earn Scene+™ rewards, allow you to earn points on eligible everyday purchases made on your card which can help to make life a little more affordable when you redeem your points through the Scene program.

Scene+ rewards can be redeemed at any time for things such as a credit on your credit card account, gift cards, merchandise or even for covering travel expenses.

You can use Scotiabank's credit card rewards calculator to estimate how much you could earn with Scotiabank’s rewards credit cards.

4. Consider the 50-30-20 rule

This popular budgeting guideline provides a framework for budgeting that helps you be more disciplined about the money you spend. The 50-30-20 rule suggests dividing your after-tax income into three broad categories:

- 50% for necessities — like housing, utilities, groceries, transportation and other needs crucial for maintaining a basic standard of living.

- 30% for wants — this includes discretionary spending expenses like dining out, entertainment and other lifestyle costs.

- 20% for savings and debt repayment – this portion is vital for building an emergency fund, saving for future goals (like buying a home or education) and paying down debts.

Though the 50-30-20 rule is a helpful guideline, it isn’t something that can work for everyone, particularly in cities with higher rent costs where you’ll need to give a higher percentage to necessities. You’ll need to find a balance that will work for you. You can start by setting up budgets in Scotia Smart Money. You can also meet with a Scotia advisor who will work with you on a budget and financial plan that works for you and helps you meet your goals.

5. Consider adding income sources

Think about ways you might earn more income, like through passive income streams, where you do the work upfront and then collect payments over time.

- Real estate: If you are in the financial position to, investing in real estate can be a catalyst for financial growth and can help create a steady and reliable source of passive income. By purchasing residential or commercial units, you can receive regular rental payments to cover the cost of your mortgage and any surplus becomes passive income. Real estate also can appreciate over time, increasing the value of your investment.

- Dividends from investments: Dividend stocks pay out a portion of their earnings to shareholders in the form of dividends. When you invest in these stocks, you receive regular, often quarterly dividends, creating a consistent passive income stream. If you reinvest the dividends you receive, you can benefit from compounding returns. Over time, as your investment grows, the amount of dividends paid out also increases.

6. Pay down debt and consider STEP

Debt payments can quickly eat up money coming into your account. If you have high-interest debts (credit card balances, for instance) consider consolidating them into one loan with a lower interest rate. You’ll have lower monthly payments — and improve your cash flow.

One way you can do this is through the Scotia Total Equity ® Plan (STEP). If you own a home and have outstanding debt like credit cards, consider if a Scotia Total Equity Plan is right for you. A Scotia Total Equity Plan lets you use the equity you hold in your home to consolidate or restructure your debt at a lower interest rate, which can lower your monthly payments. Learn more about how the plan could work for you by trying out our STEP calculator. A Scotia Home Financing Advisor or your Scotia branch advisor can also help walk you through how a Scotia Total Equity Plan could work in your overall financial plan.

7. Change your mortgage terms

One way to potentially increase your cash flow is by lowering your monthly mortgage payment with a refinance. A mortgage refinance can add some breathing room to your budget. For instance, a longer repayment period may cost you more interest over the long run, but it may also lower your monthly payment amount and improve your cashflow.

Re-amortizing your existing mortgage can also offer some breathing room. Re-amortizing is a way to reduce your mortgage payment by resetting your amortization period, which is the number of years that it’ll take you to repay your mortgage in full. If you chose an accelerated payment option to save on interest costs when you got your mortgage or if you made prepayments to reduce your amortization period, you may be able to increase your amortization period back up to your contractual remaining amortization to reduce your payments and improve cash flow.

Learn more about Scotia’s mortgage options that could help improve your monthly cash flow.

In a positive cash flow position? This is a great opportunity to make a bigger dent in what you owe, depending on your mortgage agreement. Some options:

- Make lump sum payments: Take advantage of prepayment privileges and you can repay up to 10%, 15% or 20% of the original principal amount of your mortgage at any time during each year of the term.5

- Match-a-Payment: You can pay off your mortgage sooner if you pay an extra regular mortgage payment of principal, interest and taxes on any regular payment date. The extra amount goes directly toward paying down your principal without a prepayment charge.6

- Increase payment frequency: Consider switching from a monthly payment to a biweekly or weekly frequency. More frequent payments may help you cut out years of extra mortgage payments and be mortgage free faster.

- Shorten your amortization period: While your payments will be slightly higher, you’ll shave years off your mortgage. Use our mortgage payment calculator to figure out how much interest you could save if you shorten your amortization period.

Find out more about how you can pay off your Scotia mortgage faster.

8. Adjust for changes in income or expenses over time

Life changes. Be sure to revise your cash flow statement when significant changes occur, like a new job or increased expenses. Also, reviewing your financial plan with your Scotia advisor on a regular basis will help you understand your spending habits and keep you on track toward reaching your financial goals.

Bottom Line

Where your money goes shouldn’t be a mystery. Calculating your net worth and mastering your cash flow are the first steps to helping you achieve financial clarity. Knowing where you stand helps you see your financial goals in a new light — and gives you the tools you need to achieve them.

Interest on the credit balance in your Target Account (defined below) will be paid in accordance with the terms of your Day-to-Day Banking Companion Booklet.

In addition to the interest payable on your Target Account, by enrolling into a Smart Savings Tools option, you will be eligible to earn the bonus interest (“Bonus Interest”) on the daily account closing balance in your eligible Money Master Savings Account (“Target Account”). Within approximately five business days after you have successfully enrolled your Target Account in one of the Smart Savings Tools options and for so long as it continues to remain enrolled, your bonus interest rate will be applied daily to the entire daily account closing balance.

Your Bonus Interest will be calculated daily and payable monthly. The bonus interest rate is an annual rate and is subject to change with or without notice. For the current bonus interest rate please go here.

This Bonus Interest cannot be combined with any other bonus interest offer applicable to your Target Account. If you accept an offer for any other or additional bonus interest offer on your Target Account, you will no longer be eligible to receive the Bonus Interest and such Bonus Interest will automatically no longer be applied to your Target Account as of the date of your acceptance of any such offer. This feature is subject to change or be cancelled at any time.