Key takeaways:

Do any of the following scenarios sound familiar?

You dread going to work every day because of a demoralizing boss. Your home no longer feels like where the heart is due to your toxic roommate. Or maybe you feel like it’s time to split with your romantic partner.

Whatever your struggle is, it’s easy to feel trapped in a situation that does not feel right if you don’t have an exit strategy. This is a vulnerable position to be in (and far too many people have been there), but no one should get stuck because of financial restraints.

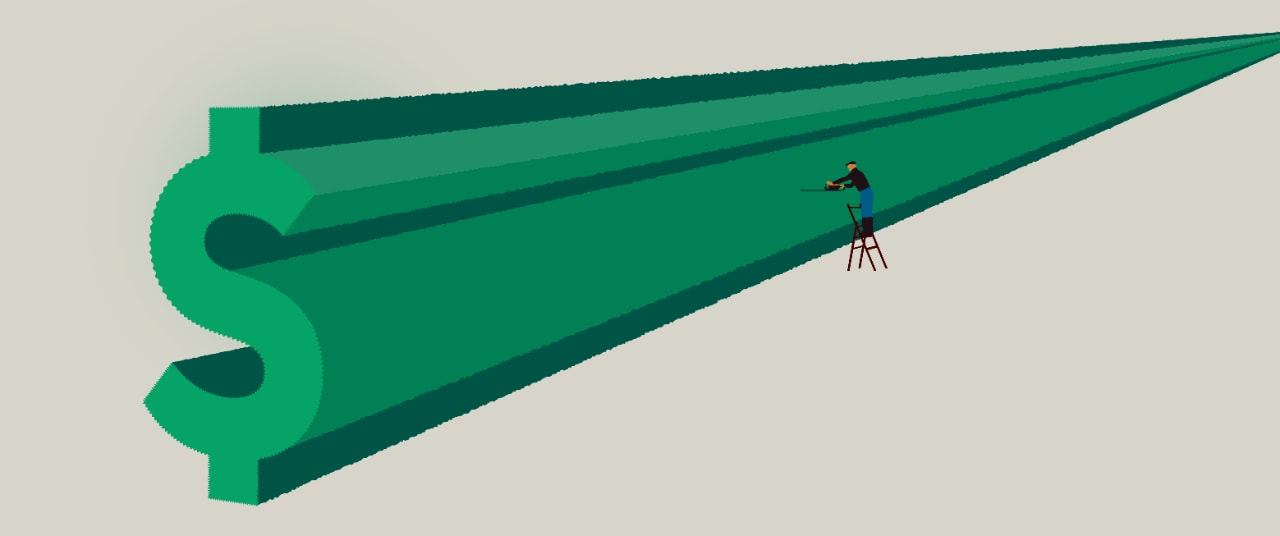

This is where a Forget You fund comes in. Consider it a safety net that gives you the autonomy to cut and run when a situation is not good for you.

A Forget You fund is a savings account that allows you to say, “I’m mad as hell, and I’m not gonna take it anymore!” (from the 1976 film Network. Thank you, Peter Finch!). When the going gets too tough, this money empowers you to move on to greener pastures.

Everyone’s situation is different, so there’s no one perfect number for your fund. Ideally, you would have approximately six months of take-home pay, meaning whatever you need to cover all of your bills and living expenses. If you are self-employed–– err on the side of caution and have enough to cover 9 months. But this amount will vary depending on your living situation, what additional support you have and how easy it is for you to find other work. The number should essentially be whatever you need to feel secure in making bold moves.

The best way to start is to create a budget so you can see where all of your income is going and where you might be able to cut back so you have more to set aside.

First, calculate all sources of consistent income and then list all of your expenses. Your monthly expenses should then be divided into two sections:

- Necessary costs like rent or mortgage, bills, car payments, groceries.

- Non-essential costs are things you want but don’t need, like dining out, vacations, entertainment, newest model electronics, luxury clothes, or skincare.

The latter is where you will look for your Forget You fund contributions. Mental health, leisure activities and self-care are essential, so perhaps you can get creative about how to take care of yourself without a high monthly cost. Skip the gym membership and work out outside with friends. You could DIY those nails or take up thrifting. However you do it, chances are there are a few areas where you can cut back and start building up that fund.

Want to get there faster? Put your other hobbies and skills to work and consider a side hustle.

New to budgeting? No problem–– Scotia has several ways to help you get started, like Scotia Smart Money by Advice+ on the Scotiabank app that gives you access to money management features that will make it easy to track your bills, monitor your spending and manage your cash flow*. You can also use the Scotiabank Money Finder Calculator, which compares your income and expenses and gives you a better sense of how much available money you have to put towards your savings.

Since you may want access to this money in a flash but aren’t touching it for your daily latte (which you can now happily cut back on to help fill that fund), a good bet is a HISA, high-interest savings account. This will help you grow your Forget You fund faster.

Book an appointment with a Scotia advisor to learn more about which savings account is the best fit for you.

Note that your Forget You fund is not the same as an emergency fund, which you should keep intact for unforeseen circumstances like when the car bites the dust, your dog swallows a wind-up toy or the roof caves in. While an emergency fund is there to protect you from unforeseen catastrophes, the Forget You fund empowers you to follow a dream or walk away from a nasty situation without worrying about how you will make your car payment. Both are incredibly important but should be kept separately.

Financial freedom can mean being comfortable enough to live the lifestyle you want without the burden of limiting your budget. It also means having the power and stability to say 'no' to the things that no longer serve you. Starting now and saving early means you are on your way to having the freedom to live your life on your terms.