Canadians are worrying a lot right now.

We get it — there's so much to worry about. From the increasing costs of food, gas and utilities to concerns about how these expenses will affect your long-term plans like retirement, there’s a lot to think about when it comes to your money.

We care about what you're worrying about, which is why we conduct quarterly surveys to better understand what's keeping Canadians up at night.

In this article

- Let's dive into the results

- Just how many Canadians are worried?

- How are expenses changing?

- What are people worrying about?

- So, what can you do?

Our most recent survey found that financial worries have been increasing steadily for the last 12 months. What are Canadians most worried about? At the top of the list: Covering day-to-day expenses, saving for emergencies and paying off debt — all things that high inflation is making harder. While inflation peaked at 8.1% in June, Canada's reported inflation rate in August was still at 7.0 %.

No matter where you sit on the Worry Index, we'll help you better understand what's going on with your, and your fellow Canadians, financial worries.

Our results are from our most recent Scotiabank Worry Index. In this index, we divide Canadians into four sub-groups based on their responses to several questions based on their finances.

- Strained: The 27% of Canadians who are struggling the most with financial pressure and spending the most time worrying.

- Vulnerable: The 28% of Canadians who are vulnerable to potentially landing in the strained group. They're getting by but worried that an unexpected setback could throw them off course.

- Secure: The 19% of Canadians who are doing relatively well and aren't worrying all the time but might have needed to cut back a little recently.

- Thriving: The 26% of Canadians who are doing great. They're making more than enough to cover their needs, but they still worry about their finances.

Our survey indicated that Canadians who fall into the strained group are more likely to be women, younger or middle-aged, reside in Alberta and have a lower household income. Meanwhile, thriving Canadians are more likely to be men, older, reside in Quebec and have higher household incomes.

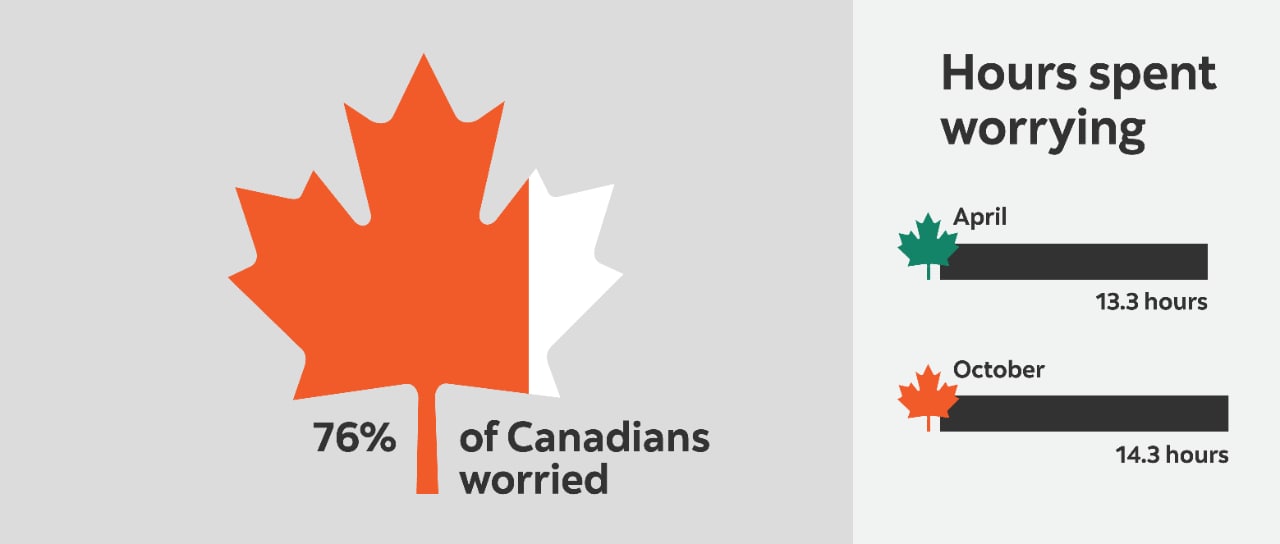

This quarter, we found that 76% of Canadians are worried about the rising cost of living and the impact this has on their personal finances. That likely checks out with what you're hearing in your friend groups or from colleagues.

What might surprise you is how much time Canadians spend worrying about money. The average Canadian worries about financial issues for 14.3 hours a week. That's an increase of one hour since we last polled Canadians in April.

One of the things worrying Canadians are their finances. They're staying up at night thinking about how to pay for day-to-day expenses, save for emergencies and grow or protect their investments.

Which province is worrying the most? British Columbians. And they're worrying 10 hours more a week about their finances than last quarter.

Canadians aren't worrying in the same ways across the board. While the average number of hours Canadians are worried is 14.3 hours per week, strained Canadians are worrying 24.5 hours a week, while thriving Canadians are worrying just 5.4 hours per week.

Strained Canadians are focused on these worries:

- The rising cost of living (98%)

- The price of things increasing faster than income (95%)

- Being able to pay for day-to-day expenses (62%)

- Finding ways to save for an emergency fund (50%)

- Finding ways to pay off debt (49%)

Vulnerable Canadians are worried about:

- How to grow and protect investments (41%)

- Finding ways to contribute to retirement (37%)

- Finding ways to save for an emergency fund (37%)

Secure Canadians' worries are about:

- How to grow and protect investments (50%)

- Finding ways to pay off debt (34%)

- Finding ways to save for an emergency fund (29%)

- Finding ways to contribute to retirement (29%)

Thriving Canadians are worrying about:

- How to grow and protect investments (42%)

- Finding ways to contribute to retirement (35%)

- How to save for a house or large purchase (29%)

Worrying feels horrible, especially if you're losing sleep. Taking action is one of the most powerful defences against worrying, which is often based in uncertainty and fear. So, learning more, getting help and creating a strategy can help you feel more in control.

Your Scotia advisor can work with you to come up with a budget and overall financial plan to help you navigate the current economic times.

Details on the methodology

Scotiabank Worry Index study was conducted online between July 21st and July 26th, 2022 by Maru/Blue on behalf of Scotiabank. A total of 1,517 adult Canadians (18+ years of age) who are the primary/shared decision makers for household savings and investments were drawn from the Maru Voice Canada panel. The overall data has been weighted by age, gender, and region to be representative of the Canadian adult population.