Preparing to send your kid off to post-secondary is an exciting and emotional time. As you help them get ready to pursue their higher education, you're likely to have questions about the cost of tuition and student living expenses, or how you can help your kid secure the student financing they need.

Here are some answers to help you and your kid feel more informed and comfortable with the student financing process and the higher education journey ahead.

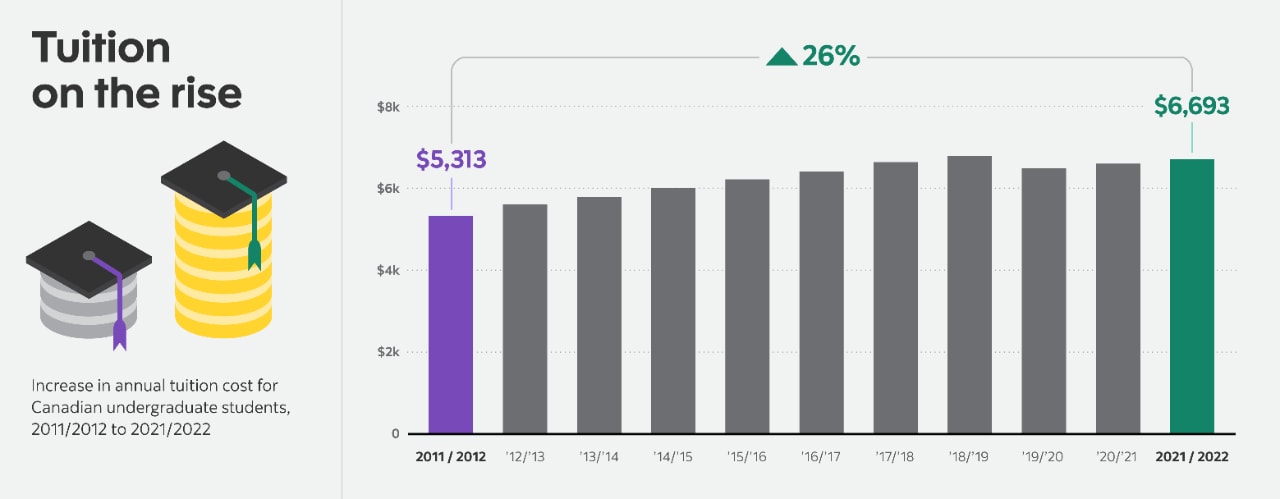

The average cost of tuition for an undergraduate program in 2021/2022 is $6,6933. If your kid wants to enroll in a professional undergraduate degree like dentistry or law, the cost will be substantially higher.

In addition to tuition, you'll also need to account for the cost of books and other course materials, which usually fall in the range of $800 to $1,000 per academic year.4

Cost of living can vary greatly depending on many factors, including whether your child plans to live at home, on or off campus. If the goal is to save money, having your child live at home while they attend post-secondary can make a big difference. However, if they plan to go to school out of the province or like the idea of living away from home, they'll need to budget for an increase in living expenses. Living costs to consider include:

- Accommodation

There are pros and cons to living on and off campus. On-campus living is often more convenient and can help to reduce travel costs. In an off-campus rental, your child can reduce their costs by living with multiple roommates and splitting rent and utilities. Where your child goes to school will also have a huge impact on the cost of their accommodation. An off-campus rental in Toronto or Vancouver is likely to be much more expensive than a rental in a small town in Nova Scotia or Saskatchewan.

- Food

Some schools have a mandatory meal plan for first-year university students who live in their residence. A meal program can cost anywhere from a few hundred dollars to a few thousand dollars per semester. Those living off campus will have to budget for groceries and be ready to do their shopping and food preparation.

- Transportation

A transit pass is often included in the cost of tuition. If your kid uses public transport, this is one way to cut down on costs. If your kid will drive to school, it's important they consider the cost of gas and parking in their overall budget. Students who plan to attend school outside of their home province or territory should also consider the cost of travelling home for holidays or summer vacations. Be sure to encourage them to inquire about student discounts whenever they book flights.

- Entertainment

Being a student is a lot of work, but it can also be a ton of fun. Don't forget to leave some room in the budget for entertainment costs. This might include a little bit of money each month to pay for streaming services or going out for a bite to eat.

If you're wondering how your kid can finance their post-secondary education, there are a few options.

- Registered education saving plan (RESP)

First, if you invested in a registered education saving plan (RESP), you can help your kid put this money to good use once they graduate from high school and enroll in a qualifying post-secondary program. They can use this money for any education-related costs.

- Government grants and student loans

If you're looking for support beyond an RESP, the Government of Canada offers grants and student loans to part-time and full-time students through the National Student Loans Service Centre (NSLSC)opens in a new tab. When your kid applies for student financial assistance, they'll be automatically assessed for grants and student loans.

The average cost of tuition for an undergraduate program in 2021/2022 is $6,693.4

They don't need to repay any grants they receive but will need to repay their loans after finishing school with interest. How much they qualify for will depend on different aspects, including:

- Province or territory of residence

- Family household income (how much you make can impact how much your kid can receive in student financing)

- If the applicant has dependents

- Tuition fees and living expenses

- If the applicant has a disability

Based on these factors, your kid may receive enough money to cover their tuition and living expenses. If they don't get enough, there are other options available to fill the gaps, such as private student loans.

- Private student financing

Private student loans are typically issued by banks and other financial institutions. One of the most popular types of private student loans is a student line of credit. Your child can use a line of credit to pay for expenses related to their post-secondary education, including tuition, books, food or transportation.

A line of credit works similar to a credit card in that you can borrow money repeatedly up to a certain amount. Like a credit card, your child can use it to borrow money when they need it, pay it back, and then borrow again up to their credit limit.

There are a few notable differences between a student loan and a student line of credit:

| Government student loan | Private student line of credit | |

| Loan amount | There are loan limits on the maximum amount of combined federal and provincial student loans that can be received | You can often borrow more money than you can get with a government student loan |

| Co-signer requirement | No co-signer required | A co-signer may be required without a strong credit history |

| Repayment amount | Comes as a lump sum amount that must be repaid in full and with interest when your child finishes school | Your child is only responsible for repaying the amount of money they use Some products, like the ScotiaLine® Personal Line of Credit for Students, offer deferred principal payments, with interest-only payment while your kid is still in school, as well as a 12-month grace period post-graduation. As these terms differ from one product to another, it’s good to compare a few options |

| Interest payments | Interest rate payments don't start until your child finishes their program or leaves school | Interest payments begin as soon as they borrow the money |

| Access to repayment assistance | Eligible to apply to the Repayment Assistance Plan (RAP) | Not eligible for RAP |

If you’re interested in learning more, check out our guide to student loans in Canada.

Beyond the different student financing options available, there are other ways to support your child in their dreams of obtaining a higher education.

For instance, encouraging them to open a student bank account to ensure they have somewhere for their grant or loan money to go. You can check out Scotiabank's Student Banking Advantage Plan, which is specifically designed for student life. The Student Banking Advantage Plan comes with no monthly account fee, unlimited debit and Interac e-Transfer† transactions and the ability to earn Scene+ points on everyday purchases.1

Similarly, you can assist your kid in signing up for a student credit card and give them advice on responsible credit card use so they can avoid unnecessary debt. Scotiabank offers no-fee student credit cards that your child can use to build their credit history and collect rewards.2

Finally, you can help your child obtain the student financing they need by assisting them in the application process for government loans and grants or a private student line of credit.2

Getting ready to head off to post-secondary is a big deal for your kid - and for you. In addition to being a very exciting time of life, it can be tricky to navigate if you aren't familiar with the ins and outs of scholarships, grants and student loans. Start researching different schools and funding options early on to ensure you and your kid have the time you need to make decisions and properly budget and save for their education.