Key takeaways:

If you own a small business or are self-employed, you may see mixing your personal and business finances in one bank account as a way to keep things simple.

But even if you used personal money to launch your start-up or your business is a sole proprietorship, the opposite is likely true. Read on for seven good reasons to set up a business bank account.

The difference between these two accounts is more than what they are called. A personal bank account is designed to help you manage your individual income and costs, like household expenses. A business bank account is designed to manage the cash flow and expenses that come with running a business.

It may be especially tempting to use your personal bank account for your business finances if you have a sole proprietorship (which isn't a separate entity for tax and legal purposes). Or, if you have a start-up that you're contributing personal funds towards. There's also the time it takes to set up a separate business bank account — and more cards and PIN numbers to keep track of.

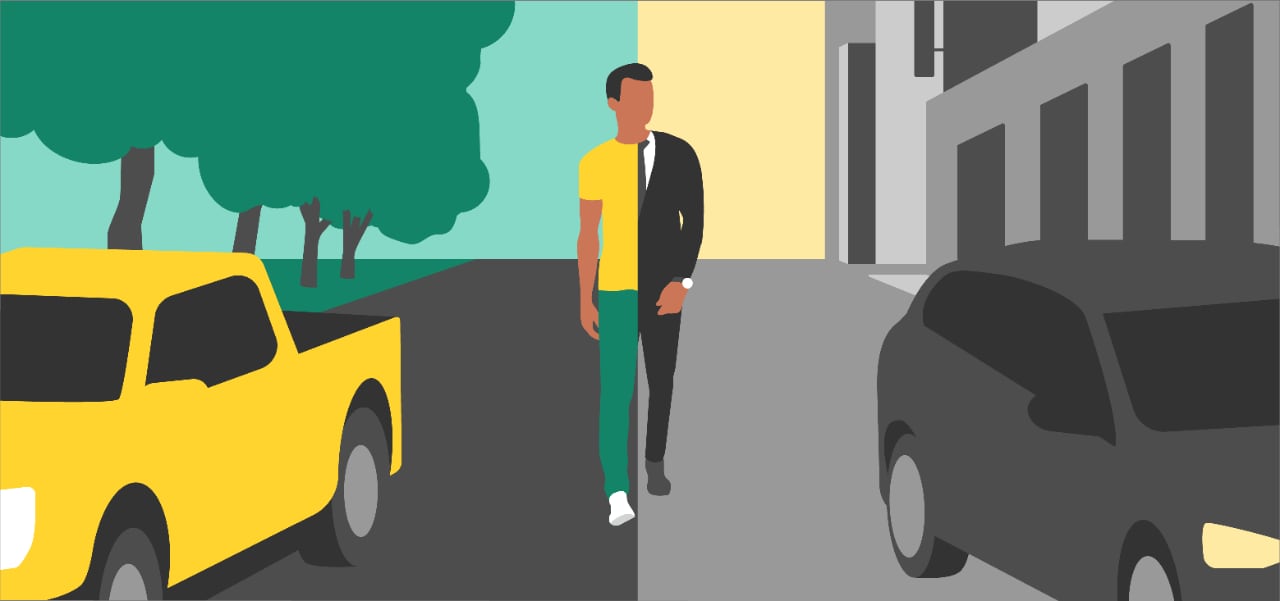

However, just like it's healthier to keep some distance between your business and personal lives, your accounts can benefit from the same degree of separation. In some cases, depending on the type of business you have, it may even be the law.

When choosing a business bank account, there are many types available to fit different needs. For instance, with Scotiabank's Select Account, you can skip the monthly banking fees when you maintain a minimum balance. For small business owners working in agriculture, Scotiabank offers the ScotiaOne Account Plan, designed especially for the industry. If your goal is to keep things as budget-friendly as possible, Scotiabank's Right Size Account might be the right fit. There's no one-size-fits-all approach when it comes to banking, which is why Scotiabank offers a variety of solutions to fill different needs.

Read more: How to open a business bank account.

1. Simplify bookkeeping

Having your business and personal income and expenses separate makes bookkeeping easier and helps you stay better organized. With a business account, your business has its own debit and credit cards. You're able to download business transactions from your business bank account and upload them into Excel spreadsheets or accounting software, such as Intuit QuickBooks, to analyze.

When your business transactions are organized and seamless, you improve your chances of success in addition to giving real-time insights into how your business is performing.

2. Improve cash flow management

Keeping up-to-date records of your business income and expenses allows you to respond quickly to cash flow needs. Understanding your business cash flow is valuable intel when the time comes to grow your business, such as when you need to:

- Invest in new equipment or technology

- Hire more staff

- Expand your marketing efforts

With a business bank account, you can secure business loans and credit cards to help with new business costs, so you don't have to wait to invest.

In addition, if you link your business bank account to a credit card processing service, your customers can pay for your goods or services with credit and debit cards. Accepting electronic payments expands your customer base and increases your revenue — and your cash flow.

3. Build credibility

You've probably heard the expression, “Dress for the job you want." With a separate business account, your business name will appear on your cheques and other payment methods. You can even include your business name on your business credit card. This can help you appear more polished and professional to suppliers and customers.

4. Ease tax return prep

Separate personal and business accounts can make tax time preparation easier. You don't have to sort out which transactions were personal expenses and income from the ones that supported your business. If you're a sole proprietor, it can be very time consuming to unravel each transaction on your yearly bank statements — and you don't have to if you're using a dedicated business account.

Partnerships also benefit from separate accounts. This is especially true for limited liability partnerships, where each partner has to file an income tax return to report their share of the partnership income.

5. Follow the law

If you have a corporation, which is taxed as a separate legal entity from its shareholders or business owners, you're required by law to have a separate business bank account. Corporations also have greater record keeping requirements than sole proprietorships do. It's best to consult with your tax advisor about what the law requires for your business.

6. Defend from audits

The Canada Revenue Agency is more likely to audit, or review, sole proprietorships to ensure they're following tax rules. This is because business owners who work for themselves don't typically file tax agency T4 documents stating earnings, deductions and taxes withheld. If you're a sole proprietor, having a business bank account that organizes your transactions into streams will make it easier to identify these items for tax compliance.

7. Raise your business credit rating

Opening a business bank account offers the potential to increase your business credit score. You can grow your credit over time by using your business credit card to make business purchases and then paying it off in full each month. A higher credit score makes it easier to get approved for a line of credit or a small business loan to increase lending amounts. As a bonus, having a business bank account can also reduce the risk for fraud, missed expenses, late fees, withheld inventory shipments and other supply chain issues, which can all negatively affect your score.

8. Simplify your banking tasks

If you choose to open a business account, you can simplify your banking tasks by using the same bank for your personal and business accounts. When banking in person, you to perform all your banking tasks at one location. Similarly, when banking online, you can easily switch between your personal and business accounts all within one website or app.

Having one bank for both accounts can also make it easier and less expensive to transfer earnings or salaries from your sole proprietorship to your personal account. Additionally, some banks offer complimentary services when you use more than one of its products. Finally, when you bank at one location, your Financial Advisor and Business Advisor are on the same team and can work together to help you meet your financial goals.

Read more: How to open a business bank account.

Apply now for a Scotiabank business account

If you choose to open a business account, you can simplify your banking tasks by using the same bank for your personal and business accounts. When banking in person, you to perform all your banking tasks at one location. Similarly, when banking online, you can easily switch between your personal and business accounts all within one website or app.

Having one bank for both accounts can also make it easier and less expensive to transfer earnings or salaries from your sole proprietorship to your personal account. Additionally, some banks offer complimentary services when you use more than one of its products. Finally, when you bank at one location, your Financial Advisor and Business Advisor are on the same team and can work together to help you meet your financial goals.

Read more: How to open a business bank account.

Apply now for a Scotiabank business account

In addition to the seven reasons outlined above, a business savings account could help increase capital that you haven't yet deployed by taking advantage of interest rates, or act as an emergency fund for your business. This may impress lenders looking at the health of your business.

There are key differences in monthly fee structures between personal and business accounts that you should keep in mind. These are typically based on the account type and number of transactions. Some accounts have maintenance fees and offer services like depositing for free; others have minimum balance requirements. Speak to your Business Advisor to find the right account for your business needs.

Scotiabank knows your small business is a big deal and we're here to serve you. That's why Scotiabank has dedicated Business Advisors, banking products and programs tailored to support small businesses like yours.

This is the easiest question to answer! You can open a business bank account online or in a branch with the help of a Business Advisor.

Takeaways

There are many reasons to separate your personal and business accounts that benefit both you and your business. Having a business account will help you simplify bookkeeping, improve how you manage your cash flow, and improve your business' credibility and raise its credit rating. Depending on your type of business, it may also be the law.