With large tuition fees and rising living costs, saving money while you're in school can feel complicated, no matter what kind of monthly income or savings you've scraped up. But there are steps you can take to make the most of your money so that you can make the most of your time when you're not sitting in a lecture hall or studying.

One of the key things to saving money while you're learning is to take advantage of the many perks afforded to anyone with a valid student ID, including special student discounts, basic coupons, freebies and more. It may take some creativity, a little planning and an extra bit of organization. But if you commit to shaving your spending now, you might be able to thank yourself later with memories you wouldn't have been able to afford otherwise, like an amazing concert or a weekend road trip with friends.

Here's a rundown of just some of the ways you can save money while in college.

Creating a budget is an important first step as you plan out your school year.

Add up all of your potential sources of income, including side hustles, work-study gigs or other part-time jobs, student loans, grants, bursaries, gifts or other sources of financial aid. Then minus whatever essentials you can't skip, such as utilities, cell phone payments, WiFi, food, commuting costs and more.

Doing this will help give you a clearer picture of how much your budget can stretch when you spend money on non-essentials. If you don't have a budgeting strategy yet, take a look at this budgeting guide for students.

If the money in your student bank account has a tendency to disappear each month, it's time to get serious about tracking your spending more closely. Even if you think you're pretty good at watching where your money goes, it's still a good idea to carefully review your spending every couple of months to make sure you're still on track. You could be overspending on things that aren't that important to you without realizing it. Budgeting apps can be a great way to help keep you on track and make it easy to check your status on the go. You can also use online banking or your bank's app to review your credit and debit card transaction histories. For example, eligible Scotiabank customers can use their Scotia Mobile app to view and search transactions.

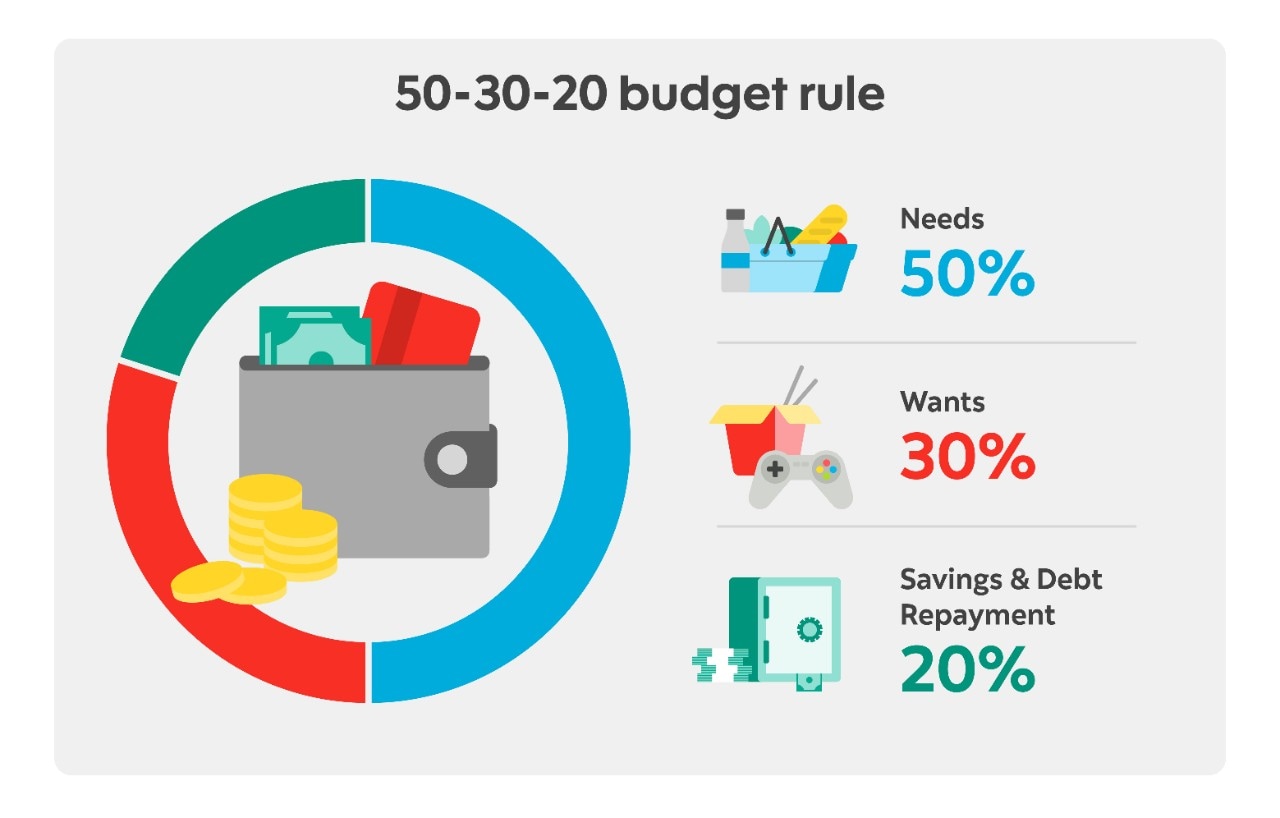

Another simple way to divvy up your budget is by using the 50-30-20 rule: put 50% of your income toward needs, 30% toward wants and 20% toward savings. Think of it as a pie chart, with your income as the circle and your needs, wants and savings as the pie pieces. But before you can make those calculations, you first need to get clear on what exactly is a need versus a want. For example, you need to eat, but how often do you need to eat out? You need to get to campus, but do you need a car, or could you take the bus?

Cutting back on the extras can make a big difference on how much you're saving.

This is the hardest part, of course, but it's important. Set up reminders for yourself to check in periodically to make sure you're still on track. It's human nature to get pumped about a brand-new plan, stick to it for a few weeks or months and then get busy and get off track. Try not to worry if you do. Just take a breath and start again. Eventually, it will feel more like a habit, and you'll be able to think about it less.

If you haven't already done an in depth search of every possible monetary gift you might qualify for, do it now. Even smaller gifts, like a few $100 scholarships, can make a big difference to making school a little more affordable.

Don't use high-interest credit to pay for fees if you can't afford to repay your credit card bills in full each month. If you need more money than you have in your savings and RESP, look into what student loan might work for you. Check out our guide to student financing to get a better understanding of what funding options are available to you.

If you pre-paid for your university meal plan, use it. Think about it as money you've already spent on something you need. Be smart about what you're spending on food: eat out when it feels worth it and you have the dollars in your budget. Otherwise, make the most of your meal plan.

Don't buy new if you can avoid it. A banged-up cover and scribbled notes from a previous student probably aren't going to make or break your concentration and will be good for the environment. Seek out used books when you can. It's also smart to check if any of your assigned reading is in the public domain. Volunteers with Project Gutenberg have digitized a lot of free books. Other organizations, including Google Books, Internet Archive and HathiTrust, also offer free e-books.

You might be tempted to hang on to your textbooks if you're sentimental or if you think you might need them later. Don't. They're heavy and bulky and you'll save more money, as well as more space, by selling them.

If you're serious about saving money, then preparing your food at home should always be your default option. You don't need to prepare fancy meals or be a great cook to eat well at home. Pinterest is full of easy dinner recipes that are great for busy students.

If you have the space to store it, you can save a lot of money by buying goods in bulk. This is an especially good option if you have roommates and can pool your budget on things you all need, like toilet paper, breakfast food, canned items and more.

One of the best ways to save money on food is to avoid anything that's designed for convenience and is then marked up dramatically in price. Do that prep work yourself. Or if you're trying to get more nutrition in your meals, skip the pricey bags of precut vegetables and turn veggies cutting session into a fun activity instead. Also consider buying veggies that look ugly or are dented: you can often find really good deals on stuff that doesn't look great but is actually delicious. Depending on where in Canada you live, you may even be able to find a fruit and vegetable subscription box or delivery service that offers big discounts on imperfect, surplus or "unique-looking" produce and other sustainably sourced grocery items.

Grabbing coffee out is fun and feels good, but it can also add up quickly. For example, if you're spending $5 or more on a daily latte, you'll need to budget more than $35 a week or over $140 a month just to fuel your caffeine habit.

You can find them online or often in your mailbox. Pair your coupon cutting with another relaxing activity, like putting a mindless Netflix show on in the background or listening to soothing ASMR videos on TikTok. Use the coupons to help you plan your week. You can save a lot of money that way.

Easy to say, but tough to do, we get it. But do take this warning seriously. Overspending on things you don't need might not seem like such a big deal now. But you'll feel the pain big time later if you run up a bill you can't afford or overdraft your chequing account.

One way to fight the urge is to online window shop - just add everything you want into your online basket and then leave it for a day. Chances are, the next time you return to it you won't be all that interested.

No matter where you live, odds are you have tons of options here. Look to secondhand stores and cool thrift shops for your clothing needs and check out other bulk and discount stores for food items and other necessities. Hunting for bargains can be a fun way to spend your extra time and extra money and it's also environmentally friendly!

You can also reduce your carbon footprint, save money and personalize your wardrobe by mending and creatively re-using old clothing. You can even remake old clothing without knowing how to sew. Check TikTok or YouTube for no-sew ideas and tutorials.

Well-known brands are notorious for marking up prices big time just because they can. Odds are you can find something just as good that's been manufactured and sold by a smaller brand or by a store's cheaper generic brand.

One of the best parts of student life is the freebies and the discounts. You can start with your school’s agenda, which usually lists brands you can score a student discount at. A lot of businesses, for example, offer major savings to students, but they don't always prominently advertise them. So don't be afraid to ask.

Access to free events and cultural attractions is another great perk of being in university. Depending on where your school is located, you could be surprised by how much cool stuff you can experience without spending a single loonie. In Toronto, for example, many museums and cultural attractions offer free admission to anyone with a valid student ID. And Montreal is notorious for its rich summer life that’ll cost you nothing.

Chances are your university also hosts a ton of free or close to free events for students. But you can likely find a lot just by scouting nearby towns and cities, or by Googling events that are being live-streamed. Check local listings for free events and ask your university if they have any free tickets available. Your local library may also offer a limited number of free tickets to museums and cultural events for members of the community. Also get creative with the free things you can do with friends. There are a lot of ways to enjoy student life without spending any money.

Bottom line

University is expensive. But living well on so much less doesn't have to feel impossible and can be a fun challenge. There's a lot you can do to make things easier for yourself and save some extra dollars. For example, you can save a ton of money, lower your carbon footprint and feel good about your spending by embracing a more sustainable lifestyle and purchasing everything from clothes to textbooks second hand, upcycling what you already own instead of buying new, eating on campus instead of always going out and proactively searching for heavily discounted food, supplies and other surplus items that might otherwise be headed for a landfill. Similarly, you can satisfy your need for culture and creativity without breaking your budget just by scouting campus and your local community for free or inexpensive events and looking up special offers and student discounts. Whatever you do, don't get complacent: the easiest way to mess up your budget is to forget about it altogether.