The continuing rise of prices has impacted many Canadian households. In the following article, we’ll provide some basic information to help you understand what inflation is, how it happens and why it happens.

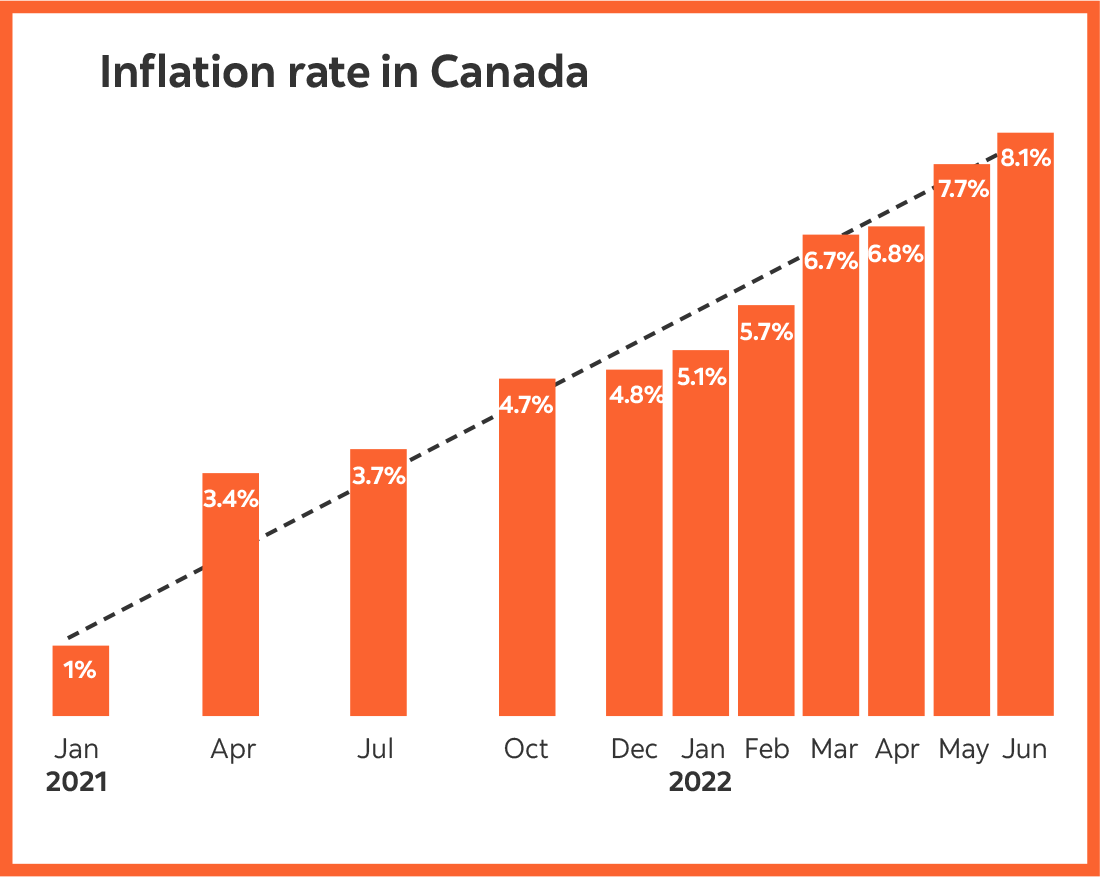

After climbing steadily through 2021, inflation has continued to climb in 2022, reaching 8.1% in June, the highest level Canada has seen in 31 years.1 Historically, the Bank of Canada (BoC) has tried to keep target inflation at 2% a year.

Inflation represents the rate at which the cost of goods and services increases over a period of time.

Essentially, the percentage change in the price of the goods and services is used as an estimate of the amount of inflation in the economy overall.

The Consumer Price Index (CPI) is one of the most widely used economic indicators in Canada. The CPI compares, over time, the cost of a fixed basket of goods and services purchased by consumers – such as food, housing and clothing.

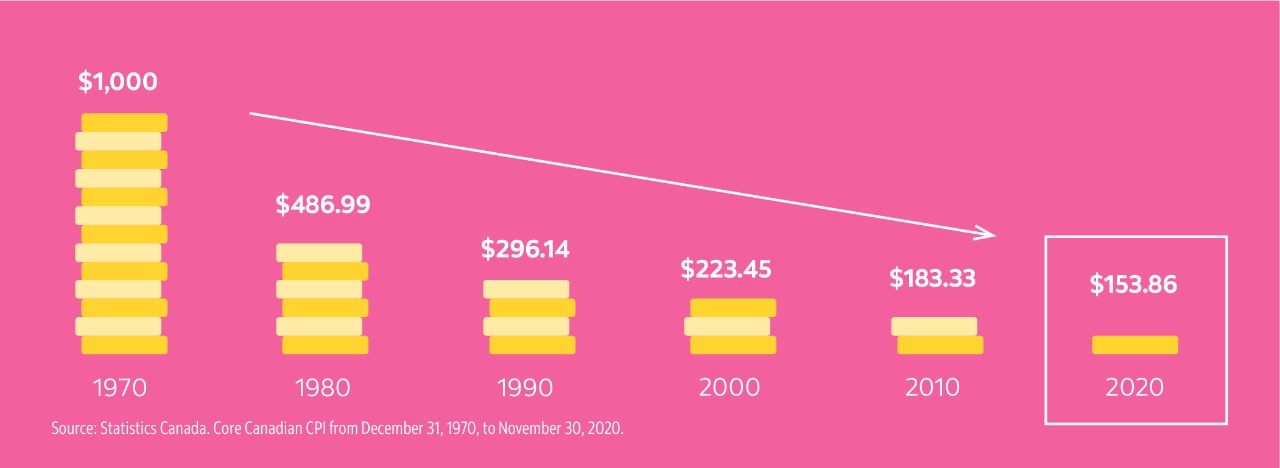

As inflation increases, there is a decrease in the purchasing power of money – in other words, as prices increase, your money buys less.

See the simple illustration below, which shows the diminished purchasing power of $1,000 after 50 years – from 1970 to 2020.

Over the long run, Canadians who earn less than the rate of inflation on their savings or investments will have reduced purchasing power when they begin spending their money. For retirees, this is especially difficult as their retirement savings will need to stretch further to pay for higher priced goods and services.

There are various factors that can cause prices to increase, but typically inflation results from:

- A surge in demand for products or services exceeding the available supply

- A rise in production costs that producers pass on to consumers

- Fiscal and monetary policy by government (for example, low interest rates, cutting business taxes, increased spending on infrastructure projects)

The Bank of Canada (BoC) actively increases and decreases interest rates to control inflation. Historically, the BoC has tried to keep target inflation at 2% a year. According to the Bank of Canada, “We (BoC) target inflation because a low, stable and predictable rate of inflation is good for the economy. When people and businesses feel confident that they know what the rate of inflation will be, they can make long-range financial plans. That leads to an economy that functions better. Average economic growth is stronger, and employment is higher.”

When interest rates are higher, they encourage people to save as they can earn a higher rate of return on their money. As a result, less borrowing and spending tends to occur. When this happens, companies may increase their prices at a slower pace or even lower prices to get people to spend again as demand is low. This reduces inflation since the prices of goods aren’t rising as quickly as they would otherwise.

Lower interest rates work in the opposite way. Not only does it cost less to borrow money when interest rates are low, but you also earn less from keeping your money in savings, which means you may end up spending more money. This increase in consumer spending could cause prices to rise as consumers are willing to pay more.

The majority of Canadians are feeling the impact of inflation on their everyday household purchases such as groceries, gas and other household items.

Let’s take a look at what Canadians are doing, or planning to do, as a result of rising inflation:2

| Action | % already doing | % plan to do |

| Reduce food waste | 66% | 20% |

| Buy less expense items at grocery store | 61% | 21% |

| Spend less on household items | 48% | 28% |

| Eat at restaurants/order take-out less often | 52% | 23% |

| Spend less on entertainment | 50% | 21% |

| Reduce vehicle usage | 49% | 21% |

| Plan for less expensive vacations | 32% | 27% |

| Buy an electric vehicle | 8% | 23% |

“Shrinkflation” – what is it and how is it affecting you?3

To deal with the impact of rising inflation, companies may reduce the amount of product in each package while charging the same prices in what’s known as shrinkflation. In other words, you’re paying the same price for less product. Experts suggest consumers can avoid shrinkflation by paying attention to the price per unit rather than the total price.

During times like these it’s important to have access to sound financial advice. Your Scotiabank advisor can recommend personalized strategies to help minimize the effects of rising inflation on different areas of your household’s finances (such as budgeting, restructuring debt, and long-term retirement planning and investing).

Occasional flare-ups like those witnessed more recently, are a reminder of the importance of having an actionable financial plan and an investment strategy that can help you maintain your purchasing power. Scotiabank offers a wide range of portfolio solutions that are built to navigate a variety of market conditions, including periods of rising inflation, and align with your risk tolerance and long-term return expectations.