Key takeaways:

Are you looking for ways to maximize your business while you continue to grow? Or are you starting to think about retirement and want to prepare your business for sale?

If you're a successful business owner or entrepreneur, a holding company can help you to achieve these ends in addition to offering several other benefits. From limiting liability to deferring taxes, keep reading to learn the benefits of a holding company.

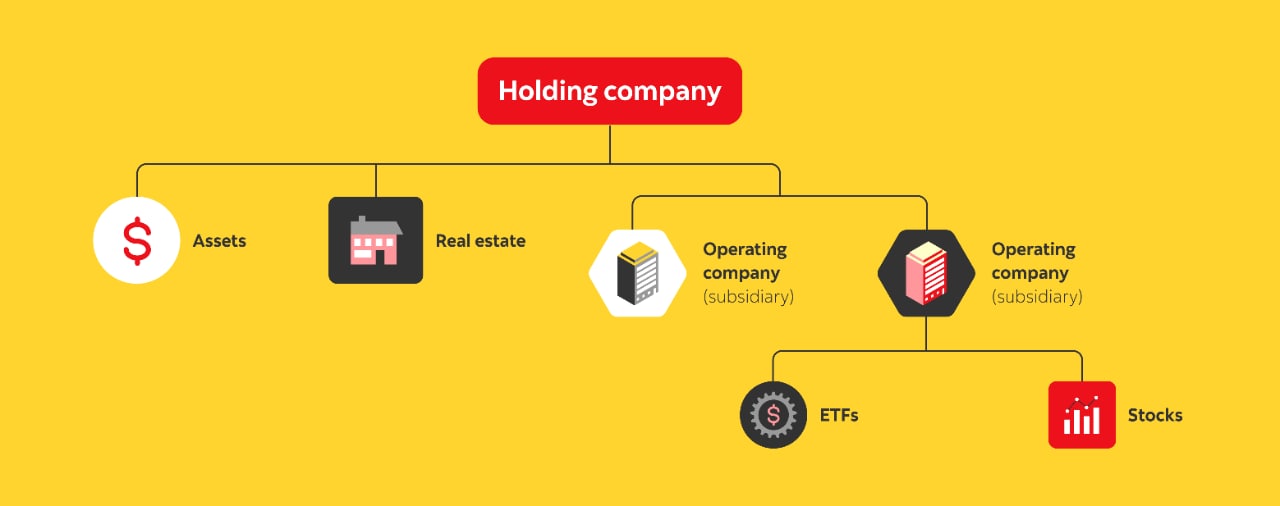

A holding company, also known as a "holdco," is a company that doesn't produce goods or services. Instead, its primary function is to hold assets.

In some cases, you can use a holdco to hold investments, such as mutual funds, real estate, or stocks.

A holdco can also hold shares of an operating company. An operating company, also known as an "opco," is an active company used to run the day-to-day operations of a business. When a holding company controls an operating company, the opco is known as a subsidiary. A holdco can control one or more subsidiaries.

There's no rule of thumb to determine which businesses should have a holding company. When deciding if a holdco is right for you, consider why you want to create one.

If your company is generating excess cash and you want to invest it while trying to defer taxes, a holdco might make sense. Similarly, if you work in a high-risk industry and want to increase the protection of your personal assets, a holdco may help you achieve this.

When deciding if a holdco is right for your business, you should always consult with a professional.

For the right business, a holding company can offer a number of benefits, including:

The regular functions of your operating company may expose your business to potential liabilities. To protect your assets against possible claims and creditors, you can use a holding company to hold excess earnings or real estate. If your operating company is sued or goes bankrupt, assets ordinarily held by a holding company will not generally be available to creditors because each is a separate legal entity.

With a holdco in place, there's also an opportunity to take advantage of potential tax savings and tax deferral.

Profits earned in an active operating company are subject to corporate taxes, which are lower than individual tax rates. After paying corporate taxes, you can distribute earnings to the company shareholders in the form of dividends. However, dividends taken out of the company are immediately subject to personal income taxes.

With a holdco, instead of personally receiving dividends, you can choose to reinvest them in the holding company. Tax rules allow for tax-free dividends to flow between Canadian-controlled private corporations. If you're a shareholder of both the holdco and the opco, you can shift profits from the opco to the holdco. This allows you to defer personal liability until you withdraw the funds for personal use.

This can allow you to plan your withdrawal in a lower earning year and potentially improve your tax savings. You may find this especially beneficial when there are multiple shareholders in the operating company as it allows each person to decide what they want to do.

You should always consult with your accountant or tax expert regarding your individual tax situation.

A holding company also allows other family members to share in the operating company profits by holding shares of the company. They can collect dividends and have them taxed at a lower personal tax rate.

There are specific rules around income splitting, also known as income sprinkling. The Tax On Split Income (TOSI) rules limit the types of income you can split from a corporation with family members.1 To determine that these rules apply to you, consult with a qualified tax specialist.

A holding company also allows other family members to share in the operating company profits by holding shares of the company. They can collect dividends and have them taxed at a lower personal tax rate.

There are specific rules around income splitting, also known as income sprinkling. The Tax On Split Income (TOSI) rules limit the types of income you can split from a corporation with family members.1 To determine that these rules apply to you, consult with a qualified tax specialist.

A holding company can also help to facilitate a more seamless transition of assets from one generation to the next. In an estate freeze, the company's share value is frozen for the original shareholders, and all future growth is passed along to the next generation.

This works by turning current shares into preferred shares and freezing these shares at a value equal to the company's current value. The new shareholders are then issued common shares for a minimal cost, and all future profits will go to them. By implementing an estate freeze, you can reduce the amount of taxes payable on income from shares.

If you're thinking about selling your business, you should familiarize yourself with the Lifetime Capital Gains Exemption (LCGE). When you profit from selling shares of your Qualified Small Business Corporation (QSBC), the LCGE could result in major tax savings on part or all of the profits you earn. If you qualify for the LCGE, you don't have to pay taxes on a portion of your profit.

Please refer to the Government of Canada website to see if your business is eligible to claim the LCGE.2

Purification is the process of transferring passive assets from your operating company into your holding company on a tax deferral basis. This can help you to meet the criteria that 90% of assets in your OPCO are used in active business. Purification is a complicated process so consulting with a qualified accountant can help determine if this is the right choice for your business.

Before you decide if a holdco is right for your company, you may want to consider the costs associated with creating and running a holding company as well as the added complexity.

• Incorporating

You can choose to incorporate online or using a lawyer. To incorporate you need to name your corporation, choose the structure, and establish a registered office address and board of directors.

• Ongoing costs

You may encounter ongoing costs, including legal or accounting fees associated with filing your corporate tax return.

• Complexity

Adding a holding company to your business structure creates a new level of complexity. If it isn't managed correctly, you could end up paying more taxes. Make sure you weigh the benefits and costs associated with creating a holding company and consult a professional before deciding if it's right for you.

Takeaways

Businesses of all sizes and across all industries have the potential to benefit from a holding company. A holdco can help to protect assets, mitigate creditor risk and defer taxes. However, using a holding company adds extra complexity to your business structure that isn't found when you own a single operating business. Ensuring you have the proper financial and legal advice can help you to navigate this complex business entity.

This article is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and The Bank of Nova Scotia is not responsible to update this information. References to any third-party product or service, opinion or statement, or the use of any trade, firm or corporation name does not constitute endorsement, recommendation, or approval by The Bank of Nova Scotia of any of the products, services or opinions of the third party. All third-party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Sources:

1. Government of Canada. Income sprinkling.

2. Government of Canada. Who is eligible to claim the capital gains deduction?