Your child has dreams. And while they might currently be dreaming of being a YouTube influencer or a video game streamer, that doesn't mean they can plan for instant internet stardom as soon as they graduate high school.

So, how do you plan for the day they decide they want to tweak their plans to become a software engineer who makes video games?

You can start a Registered Education Savings Plan (RESP). Whether your child decides to go to community college, university, trade school or do an apprenticeship, you’ll be investing in their future. No matter what they think that future looks like right now.

But higher education can be expensive. The average annual cost of post-secondary tuition in Canada in 2021-2022 was $6,693 — and that doesn't even cover fees and cost of living.1 Putting a little bit of money into a child's RESP every month or depositing a lump sum every year adds up. And as a result, your child will be able to become whatever they dream of being without having to worry as much about the cost of their education or accumulating too many student loans.

Here's what you need to know about RESPs.

A Registered Education Savings Plan is a kind of tax-advantaged account similar to a Tax-Free Savings Account. Essentially, the government encourages parents and other family members or friends, like aunts, uncles or grandparents, to save for kids' education by providing them perks through a registered account:

- Putting money into an RESP allows families to access several government grants that boost their savings.

- Money in an RESP grows tax deferred until it's taken out to pay for qualified education expenses.

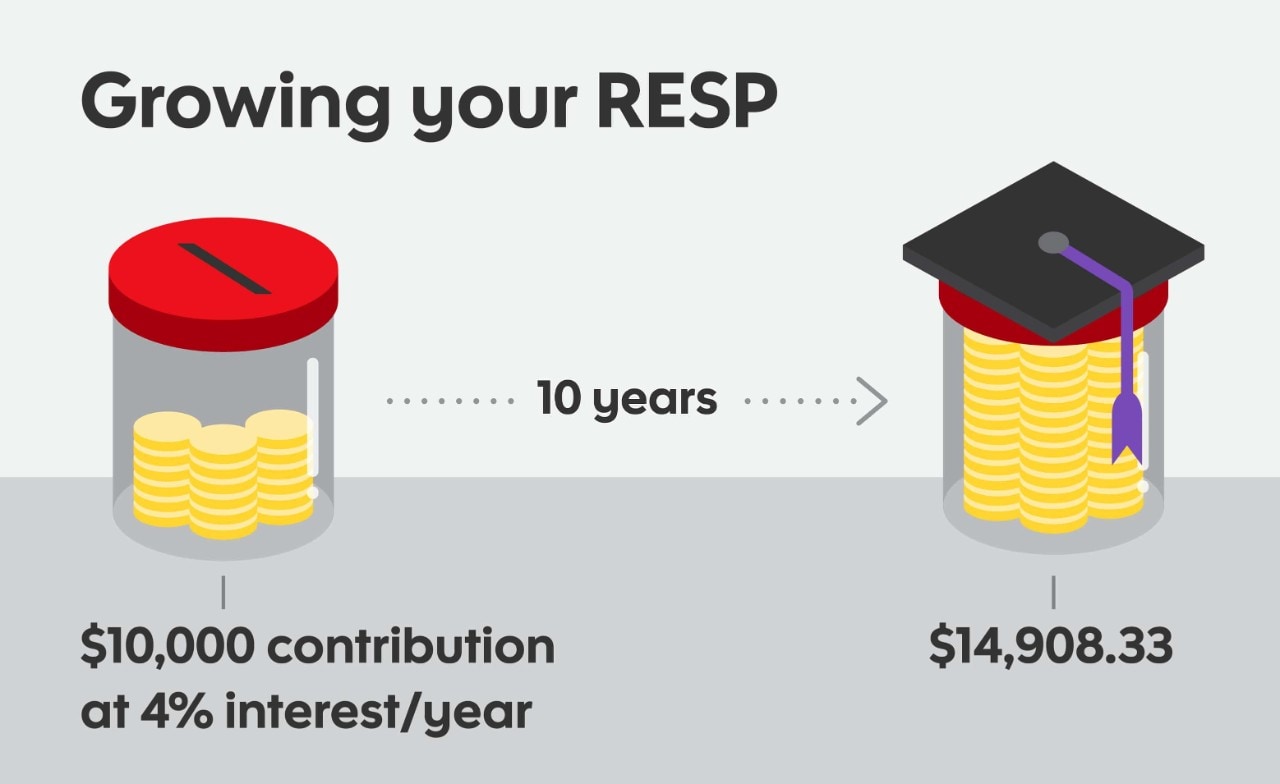

With an RESP, parents, friends or family members can make contributions up to a lifetime contribution limit maximum of $50,000 per child. That money is invested inside the RESP, allowing it to grow. Because of the amount of time contributions have the potential to grow inside the RESP tax-deferred, the student could end up with more money than originally invested.

For example, if you put $10,000 into an RESP for an 8-year-old with dreams of being a veterinarian, and that RESP earned 4% per year over the next 10 years, your contributions could be worth $14,908.33 when they're ready to head to their campus of choice. That will pay for a lot of science textbooks.

Note that the money that goes into your RESP doesn’t earn you a tax benefit (the money going into the account has been taxed like with a TFSA).

How your money could grow in the account will depend on how you invest your funds. You can work with your Scotia advisor to decide what will work with your financial plan.

If you decide an RESP is right for your child, the best time to start saving for an RESP is as soon as possible. The longer the money has the opportunity to grow in the account, the more it could potentially be worth when your child's ready to follow their educational dreams (note: this will depend on how your money is invested).

No matter how you decide to contribute, make sure you're maximizing your RESP.

The good news is that you can contribute up to the lifetime maximum of $50,000 per beneficiary. There are different ways that you can choose to contribute. You might decide to put away $50 a month starting when your child is born, make annual contributions or deposit $50,000 in a lump sum if you have a sudden windfall. How you contribute is up to you — as long as you don't go over the contribution amount. If you contribute too much, you'll have to pay tax on the over contribution and 1% per month until you withdraw it.

Unlike an RRSP, you don't get a tax deduction for making an RESP contribution. But if you want to be eligible for matching government grants in a specific tax year, you have to make your contributions by December 31 of that year. You can keep making contributions to an RESP for 31 years after it's opened.

If you're interested in an RESP, there are two main types to choose from. Each of the following offers a variety of investment options:

- A family group plan to pool contributions for one or more children in the same family until age 31

- An individual plan to name one beneficiary without age or relationship restrictions (it can even be yourself)

You're a busy parent so you'll be happy to know that depositing money into an RESP is simple. You can deposit a lump sum in a branch or via online banking or mobile banking. Alternatively, you can set it up so that you have pre-authorized contributions (PACs) taken from your bank account on a regular basis.

Regardless of how you contribute, make sure you're maximizing your RESP.

While the RESP is a strong educational savings vehicle, there are some things you need to keep in mind with it.

- Taxes on RESPs are deferred but not eliminated. Your child will potentially have to pay taxes on the money when it's withdrawn to pay for educational expenses.

- If your child decides not to go to university, college or a trade school and they don't have a sibling who can use the funds, then you'll have to withdrawn the funds and close the RESP. It means that you have return the government grants, pay withholding taxes on the accumulated earnings plus a 20% additional tax on top of that. This rule also comes into play if your child goes to university but doesn't spend all of the money.

- If your child decides they indeed do want to follow their dream of being a YouTube influencer and needs to go to a special workshop to teach them how to be the best influencer in the world, you won't be able to use RESP funds if it's not being given by a qualified educational institution.

So, if that YouTube influencer career pans out, you have several options:

- You can name another beneficiary, such as another child, if they meet the conditions of your plan.

- You can make a tax-free withdrawal of your original contributions, but any grants and bonds received must be returned to the government.

- You may be able to transfer up to $50,000 of the investment income, tax-free, to your Registered Retirement Savings Plan (RRSP) or your spousal RRSP if you have enough contribution room available.

- You can withdraw the investment income as cash, but you'll have to pay taxes on it and a penalty of 20%.

Okay, getting to those grants that we mentioned above, the good news is that federal government incentives are available to help boost your RESP savings.

Some grants that are available:

- The Canada Education Savings Grant (CESG)External matches 20% on the first $2,500 of your eligible contributions each year. Receive up to $500 per year per beneficiary under 18 to a maximum of $7,200.3 There are restrictions on eligibility for CESG for beneficiaries who are 16- or 17-year-old. In order to be eligible at this age, there needs to be $2,000 in contributions in the account that haven’t been withdrawn or a minimum annual contribution of $100 made in the previous four years.

- Depending on your net family income, you could receive an additional CESG of 10% or 20% on the first $500 contributed each year, up to an additional $100 per year per beneficiary under 18 towards the maximum lifetime CESG of $7,200.3

- Children who were born on or after January 1, 2004, depending on the adjusted income of their primary caregiver, may receive the Canada Learning Bond (CLB) which offers a $500 initial deposit, then $100 per year until the eligible beneficiary reaches 15 years of age, to a maximum of $2,000. You don't have to contribute to your RESP to apply for or receive the CLB.

If you're wondering how hard it'll be to get money out of your RESP account when you're ready to start taking out contributions, there's good news. It's easy. You just need to present proof of enrollment in a qualified educational institution, then you can make withdrawals.

Opening an RESP is simple. Financial institutions like Scotia offer Individual and Family Plan RESPs and can help you choose the plan that works best for you. Then you simply set it up like you would any other account. Be sure to bring your and your beneficiary's official government identity documents and you're done.

All you have to do is figure out your contribution and investment strategy and help your child decide what they actually want to be! (One of those things might be easier than the other.)

Contact us to get started.