Scotia Momentum®

Mastercard®* credit card

Earn 1% cash back on all eligible gas station, grocery store, drug store purchases and recurring payments.1

7.99% introductory interest rate on purchases for the first 6 months (20.99% after that; annual fee $0).2

Is this Credit Card right for you?

Right for you if you:

- Want to obtain a convenient and secure payment method for everyday purchases, that can also help you to build your credit history if you make at least your minimum payments on time each month

- Want an interest free grace period on purchases

- Value the rewards and benefits that can be earned with this Card

- Prefer to avoid annual fees

May not be right for you if you:

- Will be carrying an outstanding balance for a long period of time or using it for debt consolidation

- Don’t mind paying an annual fee to benefit from even more rewards & other benefits available with one of our other Cards

Fees, rates & other information

| Annual fee3 | $0/year |

|---|---|

| Interest rates3 | 20.99% on purchases 22.99% on cash advances (including balance transfers, Scotia Credit Card Cheques and cash-like transactions) |

| Minimum credit limit3 | $500 |

| Each supplementary Card3 | $0/year |

What's included with your Card

Booking.com Rewards

Mastercard cardholders will receive up to 7% off when booking accommodations marked with the Mastercard label and prepaying for such accommodations using an eligible Mastercard credit card at booking.com/mastercardcanada

Earn cash back on your everyday purchases1

1%

Earn 1% cash back on all eligible gas station, grocery store, drug store purchases and recurring payments.1

0.5%

Earn 0.5% cash back on all other eligible purchases.1

Scotiabank Rewards calculator

Scotia Momentum® Mastercard®* Card Cash Back Program Terms and Conditions

Get the Scotia Momentum® Mastercard®*

Apply online

Enjoy unique benefits, rewards, and so much more.

In person

Talk to a Scotiabank advisor.

You might also like

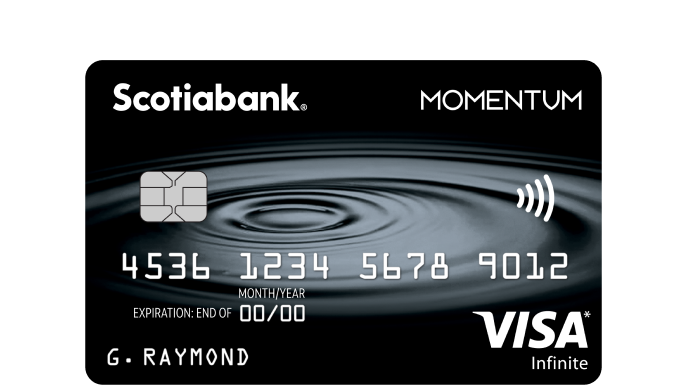

Scotia Momentum® Visa Infinite* Card

Get up to 4% cash back on eligible purchases.

Annual fee: $120

Interest rates: 20.99% on purchases / 22.99% on cash advances

Scotia Momentum® No-Fee Visa* Card (for students)

Get up to 1% cash back on eligible purchases with no annual fee.1

Annual fee: $0

Interest rates: 19.99% on purchases / 22.99% on cash advances

Discover your credit card rewards

Enter your monthly spend details to compare Scotiabank's credit card benefits and calculate your rewards.

Choose the right credit option for you

Tell us about your spending and borrowing needs and we'll help you find the credit solution that's right for you.

You will earn 1% cash back on net purchases made with your eligible Scotia Momentum Mastercard credit card at gas stations, grocery stores and drug stores as classified by Mastercard (Merchant Codes: 5411, 5541, 5542 & 5912). Some merchants may sell these products/services or are separate merchants who are located on the premises of these merchants, but are classified by Mastercard in another manner, in which case this added benefit would not apply. Recurring payments are defined as payments made on a monthly or regular basis automatically billed by the merchant to your Card. Recurring payments are typically telecommunication, insurance, membership, subscriptions, etc. Not all merchants offer recurring payments. (Please check with your merchant to see if they offer recurring payments on Mastercard cards.) You will earn 0.5% cash back on all other eligible purchases made with your Scotia Momentum Mastercard credit card. Cash Advances (including Balance Transfers, Scotia Credit Card Cheques or Cash-Like Transactions), returns, refunds or other similar credits, fees, interest charges or service/transaction charges do not qualify for cash back. See your Scotia Momentum Mastercard Cash Back Program Terms and Conditions for full details.

Offer Description and Conditions: The Introductory 7.99% Interest Rate applies only to eligible purchases subject to the conditions below (the “Offer”). This introductory rate applies when the new Scotia Momentum Mastercard credit card account (“Account”) is opened between November 1, 2024 and October 31, 2025 and will continue for 6 months from date of Account opening (the “Promotional Period”). After the Promotional Period, purchase balances at the promotional rate of 7.99% (including any unpaid balances) will increase to the preferred interest rate for purchases (currently 20.99%). There is no promotional low rate fee on purchases made during the Promotional Period. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers and cash-like transactions), interest, fees or other charges. All other terms and conditions of the Program Terms continue to apply during the Offer period. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

How we apply payments: Your payment cannot be applied to the balance(s) of your choice. In general, if you make a payment that exceeds the minimum payment on your statement, we will apply your payment on a proportionate basis among each group of billed charges on your Account. We group charges based on the interest rate that applies to the group of charges. See your credit card agreement for more information about how we apply payments to your Account.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card .(including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

For current rates and information on fees and interest cost, call 1-800-263-9495. Interest rates, annual fees and features are subject to change without notice. Learn more about credit card fees and interest rates.

The savings of up to 25% applies to Avis and Budget base rates and is applicable only to the time and mileage charges of the rental. All taxes, fees (including but not limited Air Conditioning Excise Recovery Fee, Concession Recovery Fee, Vehicle License Recovery Fee, Energy Recovery Fee, Tire Management Fee, and Frequent Traveler Fee) and surcharges (including but not limited to Customer Facility Charge and Environmental Fee Recovery Charge) are extra. The Bank of Nova Scotia is not responsible for, and provides no representations, warranties or conditions regarding this offer or any Avis or Budget products or services, including Avis Preferred Plus membership and services and those obtained under this offer, which are governed solely by Avis’ terms and conditions. Avis Preferred Plus membership and services are provided by Avis.

All Mastercard benefits are provided by Mastercard International Incorporated or its affiliates or other third parties. The Bank of Nova Scotia is not responsible for any Mastercard benefits.

If you're a Mastercard credit card cardholder, you'll receive the benefit of Zero Liability in the event of the unauthorized use of your Canadian-issued Mastercard card.

As reported in the Mastercard 2016 annual report. Subject to change.

The Primary Cardholder on the Scotia Momentum Mastercard Credit Card Account is responsible for all charges to the Account including those made by the additional Authorized User (Supplementary Cardholder).