If you’re asking “what does NFT stand for” it’s short for non-fungible token. Non-fungible refers to how it can’t be replaced or traded one-for-one because each token is unique. Each one has an unbreakable digital code. In contrast, dollars are fungible because they are all alike. NFTs are not used as currency because it would be like trading an E-Type Jaguar for an Andy Warhol painting. It can be done, but it’s difficult to determine equal value. You’ve probably got even more questions – don’t worry we’ve got some answers.

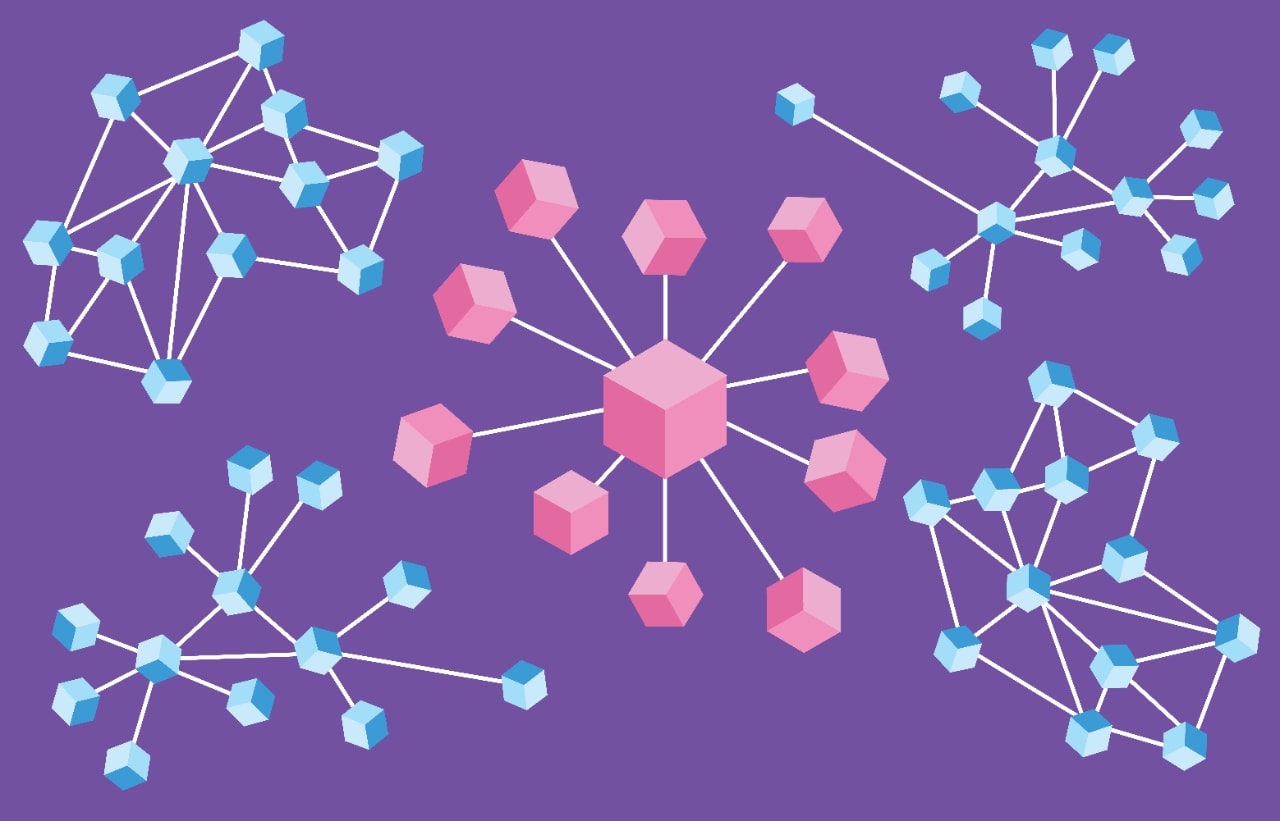

What is a blockchain?

A blockchain is a ledger, or book of financial accounts, that records sales on a digital network. The ledger is publicly available (often referred to as open-source in computer lingo) and not maintained by a central authority like a bank or government. That allows most sales to be done outside the scrutiny of regulators and authorities. That’s why some criminals favour blockchains and cryptocurrencies.

What’s the difference between cryptocurrencies and NFTs?

Both are tokens on a blockchain, but cryptocurrencies are meant to be used as money, while NFTs are not. Instead, NFTs are attached to assets. These assets can be real, though not as often. (Nike is working on attaching them to sneakers.) Most often NFTs are linked to intangible assets, such as digital art on the internet, or an access pass to a private section of a website or computer game, for instance.

Why are NFTs important?

The digital world boomed in part on the basis of how computer code containing photos, files and music, for example, was easy to duplicate. Countless copies could be made. But there was little ability to mark an original version. That changed with the introduction of blockchain technology. It creates exclusivity or scarcity where there was none by making it impossible to copy the code that marks ownership.

It’s true the image itself – the JPEG file – can be copied, but not the code saying this is the original. That can be important for digital creators such as artists to get money for their work. The ownership can’t be altered and is easily shown in the public blockchain ledger. For example, a musician could sell an album as an NFT to one fan for millions of dollars and earn more in one shot than years of streaming their music on a platform like Spotify.

How do you buy an NFT?

You can visit an NFT marketplace such as OpenSea, Foundation or Rarible. Then download an e-wallet (a place to hold digital currency) from a drop-down menu and use a credit card to buy the cryptocurrency you need to buy the NFTs. Then store the NFT in your e-wallet. Most NFTs use the Ethereum blockchain and Ether, the most valuable cryptocurrency after Bitcoin.

You can also go first to an e-wallet site such as Coinbase, MetaMask or Paypal to buy Ether or other cryptocurrencies. Then go to an NFT marketplace.

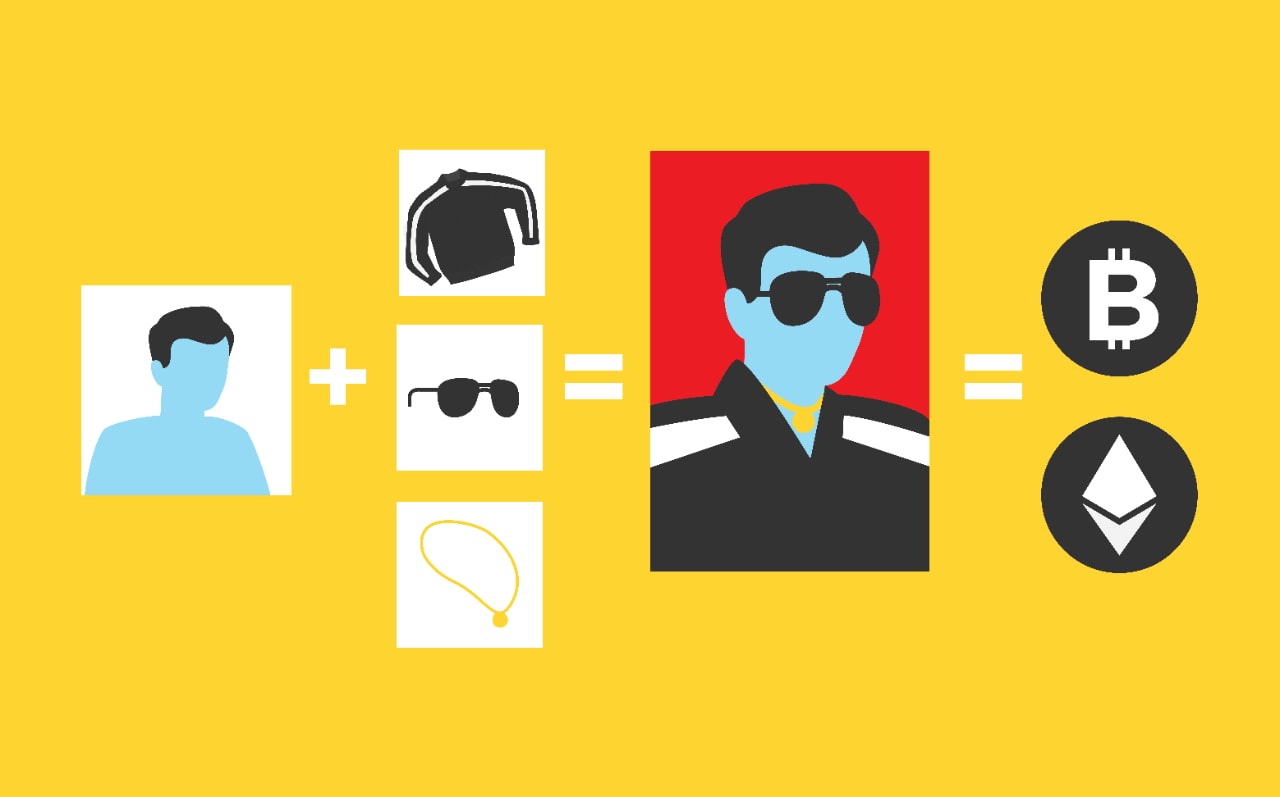

How do you create an NFT?

Creating an NFT uses some of the same tools as buying one. You need an e-wallet and an account on an NFT marketplace. You take the digital file of the NFT you want to make and upload it to the create or “minting” part of the marketplace. The cost varies according to the platform and NFT but can be about $125. It includes “gas fees,” the computing cost of using the Ethereum blockchain.

How much do people pay for NFTs?

Prices vary widely according to the type and marketplace. They are usually measured in coins of Ether. One coin is valued at about $4,000 although the exact amount changes all the time. NFTs can be used to secure ownership to items as trivial as a digital snapshot, or items more valuable personally such as internet addresses and Twitter or Instagram profile images. Works by famous digital artists such as the Bored Ape Yacht Club sell for millions of dollars.

The priciest NFT art sale to date belongs to an artist known as Pak, whose piece The Merge sold for US$91.8 million on the Nifty Gateway marketplace. However, the total value the NFT market has slid by more than half to about US$10 billion in just a few months, illustrating the unpredictable nature of this collectibles market.

Where can you use NFTs?

People are spending more and more time online shopping, gaming and banking as opposed to doing those same things on Main St. in the real world. When we dive into this world it’s called the metaverse. As we live there more, we’ll use digital objects that come as NFTs. They could be avatars in gaming, access to chat groups on messaging services or art for an online shop in a metaverse community.

Some sellers are adding real world assets to NFTs to make them more attractive to buyers and to give them utility beyond showing ownership and rarity. These assets include event tickets, signed trading cards and other items, or even copyright to the image itself, which isn’t automatically included when you buy an NFT.

What are the problems with NFTs?

NFTs and cryptocurrencies are mostly unregulated by government and banking authorities. Opponents of NFTs say they allow criminals to hide their money and how they move it around, as well as prey on people with scams and fraud.

NFTs, like assets in the real world such as art and restaurants, are used in criminal money laundering: hiding where your money comes from by passing it through different ownerships or businesses. Some NFT holders engage in wash trading, the selling of an NFT to yourself for a high price to increase how much people think it’s worth.

One type of NFT scam is a rug pull. It happens when an NFT creator convinces people to invest in a project then runs off with the money without delivering. Another trick is whitelisting. The NFTs are offered at a discount to some people before they officially go on sale. Then the lucky few sell them at a sizable profit when the market opens to all.

Scotiabank does not provide any recommendations or offer any solutions related to NFTs or other cryptocurrency assets. Speculative assets such as NFTs can involve a substantially higher level of risk than traditional financial products.

Some artists have criticized NFTs as a gimmicky money-grab that aren’t in themselves creative. They say NFTs are luxury items and pretty useless beyond trying to create scarcity. You can’t even drive them like a sports car or live in them like a mansion. Instead, they say NFTs are merely agents of financialization, which can be defined as the creeping growth of business and investing in all aspects of life whether we want it or not.

NFTs don’t usually include the copyright of the image. So, if you’re planning on turning the NFT image into merchandise, make sure to check the details of the sale. Likewise, if you want to create and sell NFTs, ensure copyright is held where you want it. Some people have accidentally given away their control over images and items in NFTs.

Electronic gamers view NFTs with concern because they can add costs to games in addition to the many small payments players already make. Think of the expense if gaming companies make you buy an NFT to get your favourite avatar, weapon or storyline.

Another argument against NFTs and cryptocurrencies is the amount of energy required to create them. It is estimated global “mining” of cryptocurrency, the use of millions of computers to solve equations which produces the currency, uses the same amount of energy per year as a small country such as Sweden and emits as much carbon dioxide annually as Greece.1

Why do some people like NFTs?

Many supporters believe they are an important digital trend, and they’ll get rich trading them. They see how NFTs allow people to create scarcity in digital objects, just like art and other collectibles in the offline or “real” world.

Supporters also say NFTs allow people to spread wealth away from traditional centres of power like governments, banks and large internet platform such as Facebook, YouTube and Spotify. They see NFTs and cryptocurrency as part of a movement to decentralize finance and the internet.

Similarly, boosters say NFTs are personal property that owners control, when so much of the internet is ruled by platforms, like Facebook telling you whether or not your post is OK. And you can take that personal property and use in it different games, apps and social media. Some call this portability or interoperability.

Even if NFTs are useless aside from showing ownership, defenders say people buy lots of things that aren’t really practical. These include exotic pets, baseball cards and jewellery. They may increase in value but mostly they’re owned for pleasure and showing off. Celebrities own NFTs so people think they’re cool and fun.

The bottom line

NFTs are part of new trends in cryptocurrencies, art and the metaverse. They are important because they create pleasure and scarcity through ownership in the digital world just like Van Gogh and Picasso pieces in the “real” world. NFTs are a risky investment, but they could also be a big part of our daily online lives. We’ll have to wait and see.