Key takeaways:

Key takeaways:

Finding a place for you and your family to live is an exciting part of moving to Canada. But it's understandable if you're feeling a bit overwhelmed: The Canadian rental market can seem complicated at first.

We break down what you need to know so you are ready to look for your new home. Here's everything you need to know about renting a home in Canada.

The rental process in Canada may be different than what you're used to. For example, there's no such thing as a "standard rental." Instead, your options will include several types of rental properties, like houses and condominiums. Also the Canadian rental market has clear rental rules and regulations that help protect both renters and landlords (which we will get into a bit later).

Although Canada is the second largest country in the world (stretching out over 9.9 million square kilometers1 ) and has one of the lowest population densities (4.24 people per square kilometer2), the rental market in Canada can be challenging. There are a couple reasons for that.

Vacancy rates. A vacancy rate measures how many rental properties in a specific area are empty, compared to the total number of rentals available in the same area. Even with such a low population density, current vacancy rates across Canada are quite low.

According to the Canada Mortgage and Housing Association (CMHC), in 2022, the average vacancy rate in Canada for purpose-built rentals (buildings with units built for the purpose of renting out) was 1.9%, and 1.6% for condo rental units.3 This means, out of all the purpose-built rentals in Canada, only 1.9% of them are empty and available for rent (and 1.6% of condo rentals are available for rent).

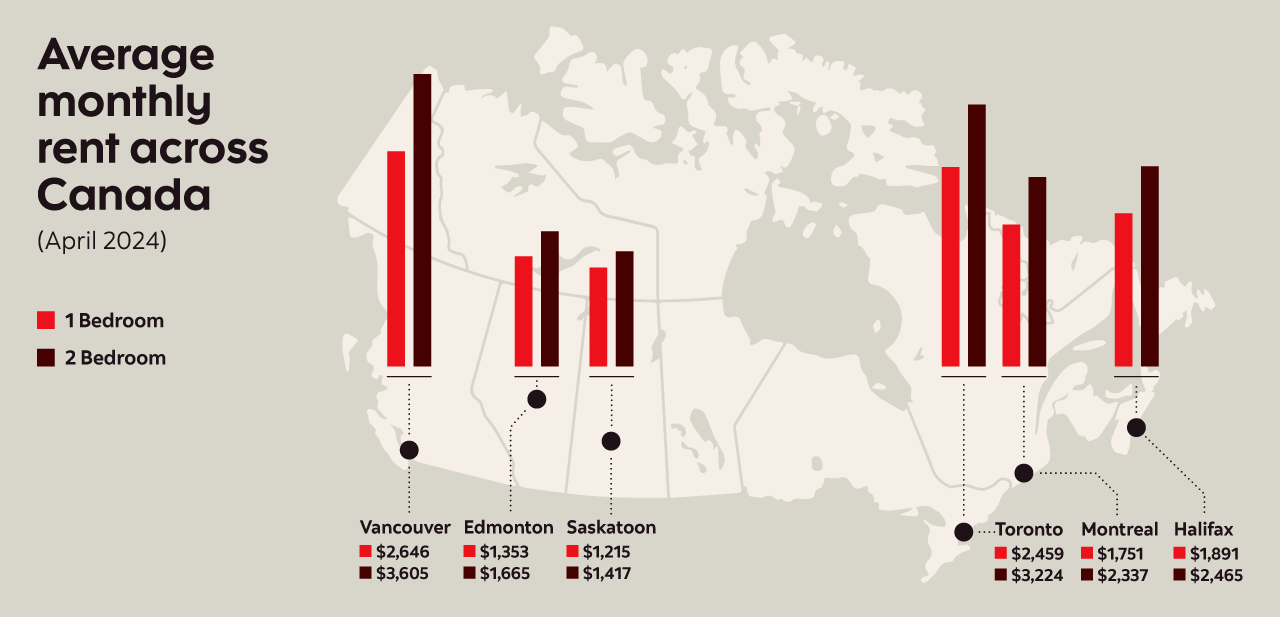

Rental rates. You'll find that average rents in Canada vary a lot depending on location. For example, larger cities, such as Toronto, Vancouver and Montreal, have higher rental rates because there's more demand for rental units. But smaller cities and towns generally have more budget-friendly rental options.

The table below shows the latest average monthly rents for one- and two-bedroom rentals in major cities across Canada. If you compare these rental rates, you can see which areas will best suit your budget.

| City, Province | 1 bedroom | 2 bedroom |

| Vancouver, B.C. | $2,646 | $3,605 |

| Toronto, ON | $2,459 | $3,224 |

| Halifax, NS | $1,891 | $2,465 |

| Montreal, QC | $1,751 | $2,337 |

| Edmonton, AB | $1,353 | $1,665 |

| Saskatoon, SK | $1,215 | $1,417 |

There are several different types of homes available for rent in Canada. Understanding what options are available will help you find a place that's ideal for you.

Houses. Houses include homes built for single families, as well as townhomes (a row of connected houses) and duplexes (two side-by-side units in one building).

Purpose-built rentals. Managed or purpose-built apartment buildings are another popular rental option in Canada. Run by professional property management companies, these types of rentals often have common elements that all residents share, such as laundry rooms.

Condo rentals. The condo rental unit is one of the more unique rental units available. These rentals are privately owned units inside a condominium complex, meaning the units are owned by an individual, not a company. Most come with common amenities like an onsite concierge, entertainment and party rooms, and fitness centres. Unlike a purpose-built apartment unit, if you rent a condo unit, you'll deal directly with the owner of the condo, rather than a property manager.

Shared accommodations. Also known as roommate arrangements, shared accommodations are a more affordable option if you're on a tighter budget. With this type of rental, you rent a room in a home, apartment or condo unit and share common areas, such as the kitchen and living room, with the other tenants.

Strong tenant rights are another great part of the Canadian rental experience. While rules and regulations vary across the provinces and territories, every jurisdiction has legislation governing the relationship between landlords and tenants.

Depending on province or territory you rent in, your landlord likely:5

- Can't restrict your access to your rental property

- Is responsible for making any necessary repairs

- Can't discriminate against you on the basis of race, ethnicity, religion, gender, sexual orientation, disability, or age

- Can't enter your rental property for repairs or inspection without giving you adequate notice first

- Can't evict you if you're not behind on your rent and haven't broken any of the terms of your lease, thanks to strict eviction rules

Landlords are also allowed to increase your monthly rent, but they have to follow specific rules, such as giving you adequate written notice and following rent increase caps. Typically, landlords can increase rent by 1% to 3% each year. The amount varies according to province, and most provinces change the limit each year.6 For example, Ontario imposed the following rent increase caps:7

- 2020: 2.2%

- 2021: 0%

- 2022: 1.2%

- 2023: 2.5%

Before you dive into your rental search, let's explore what could influence your overall rental experience.

It can be stressful when you need to find your new home quickly. Short-term rental housing might be a practical solution so that you'll get the chance to explore different neighbourhoods in your new city and see where you'd like to live long term.

Short-term rentals include serviced apartments, Airbnb rentals, and hotels or motels. There are also newcomer organizations with resources to connect you to temporary housing options.

Affordability is important when it comes to your rental home, so setting up your budget is a crucial first step. A budget helps you understand what the maximum amount of rent you can afford — and reduces the risk that you'll sign a lease for a rate that's higher than you can comfortably manage each month.

When preparing your budget, be sure to include all the related costs of renting, such as utilities, internet and tenant insurance. Not all rental properties include these costs as part of the rent. You should also include one-time expenses (like security deposits and moving costs).

Ready to rent your first place? Here are the important next steps you’ll need to take.

There are several resources to help you find homes or apartments for rent. These include:

- Online classifieds

- Sites specializing in rental property, such as ViewIt.ca and Rentals.ca

- Individual real estate agents, as well as the Canadian Real Estate Association's MLS listings site, Realtor.ca

- Social media groups, such as Facebook groups organized in specific cities to help renters and landlords connect with each other

When you find a property that you're interested in, you'll need to fill out a rental application form. These forms give prospective landlords the information they need to evaluate you as a potential tenant. The form will typically ask for things like your contact information, employment history, previous rental experience and personal references.

- Government-issued identification (such as a passport or driver's licence)

- Proof of income (such as pay stubs or income tax assessments)

- References from previous landlords or employers

Many landlords will want to do a credit check to make sure you have the financial means to pay your rent on time. Being new to Canada, you may not have enough Canadian credit history for a good credit score. Other options, such as bank statements, can help show your financial reliability.

While it's not legally required, most landlords will want you to get tenant's insurance. Also known as renter's insurance, tenant insurance provides liability and personal property coverage. It usually covers losses due to crime (such as burglaries) or natural disasters as well.

Even if your landlord doesn't ask you to get tenant insurance, it's something worth considering in case of the unexpected.

Unfortunately, the rental world isn't free from scams, such as fraudsters posing as owners renting out their property or renting property that doesn't actually exist. It's important to stay vigilant.

The following are some warning signs that a rental deal might actually be a scam:8

- Monthly rent is very low compared to similar units in the same area

- Prospective landlord wants you to pay an amount up front, before you've signed a lease

- Prospective landlord will only communicate via email

- You're asked to wire your security deposit to a foreign country

Always trust your instincts. If a deal seems too good to be true, or the prospective landlord is rushing you, it's a sign to take a step back and investigate further.

Found the perfect place and ready to sign the lease or rental agreement? Congratulations! But while it's an exciting time, you should read through the agreement carefully, to make sure you understand all the terms and conditions.

The following are some of the things a typical lease agreement covers:9

- Names of the parties involved (the landlord and the tenant)

- Monthly rental amount

- Length of the tenancy

- What's included (for example, utilities might be included)

- What isn't included (for example, air conditioning or parking might not be included)

- How either party can end the lease

Finding your first rental home in Canada is exciting. Follow these tips to make sure your rental journey goes smoothly:

- Research local rental markets: Take a look at average rental prices, available amenities and neighbourhood perks, such as walk scores (which rates how nice it is to stroll through the area) and transit scores.

- Be prepared: Have important documents, such as government-issued ID and proof of income, on hand to submit with your rental application.

- Have a realistic budget: Setting (and sticking to) a budget will go a long way toward reducing financial stress once you've settled into your new home.

- View rental properties thoroughly: Take the time to explore and inspect any property you're interested in. The CMHC's rental property evaluation form can help you stay organized.

- Consider tenant insurance: Even if your landlord doesn't require it, having tenant insurance offers protection for your home.

- Review your lease agreement carefully: Before you sign your lease, read the terms carefully and make sure you understand what you're signing.

- Be careful about potential scams: Remember, if a rental deal looks too good to be true, there may be good reason. Incredible deals are often red flags signalling a scam.

This article is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and The Bank of Nova Scotia is not responsible to update this information. All third party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

1https://www.cia.gov/the-world-factbook/countries/canada/

2https://worldpopulationreview.com/country-rankings/countries-by-density

4https://rentals.ca/national-rent-report

6https://housingrightscanada.com/resources/rent-control-policies-across-canada/

7https://www.ontario.ca/page/residential-rent-increases

8https://www.edmontonpolice.ca/CrimePrevention/PersonalFamilySafety/Frauds/OnlineScams/RentalScams

9https://www.cmhc-schl.gc.ca/en/consumers/renting-a-home/i-want-to-rent/lease-and-rental-agreements